Of course, usually the one clear caveat on the economic considered direction is the fact users which put too much into their household could become home-steeped and cash-terrible

Furthermore, more cashflow freedom once a beneficial recast homeloan payment can be probably increase future employment flexibility and improve the household’s full monetary stability. Including, down coming home loan repayments supply the debtor much more freedom to improve efforts otherwise professions (that may wanted one to earnings step back when planning on taking a few procedures forward), and also in a scene in which medical events that can cause quick-identity (or much time-term) disability try a leading cause of case of bankruptcy, which makes it easier to minimize month-to-month mortgage obligations has got the potential to reduce home loan standard chance first off.

On lender’s perspective, making it possible for automated recasting is also enticing, due to the fact recasting extra to own home loan prepayments (to attenuate coming mortgage payment debt) create lead to down mortgage stability, and you may better family guarantee towards borrower, and this reduces the exposure of the lender so you can a financial losings if there is a standard installment loan Eagle.

Still, prepaying a home loan is still roughly the same as a good guaranteed thread go back on a relatively tempting yield (than the almost every other securities), which will be actually tempting prior to equities from inside the a probably lowest get back (high valuation) environment getting stocks. On the other hand, the fact is that that have an intensity of money in home collateral is actually sooner or later not a dilemma of prepaying the borrowed funds (and you will recasting it), per se, however, of shopping for an excessive amount of household prior to the individuals internet well worth to begin with. Put differently, if you don’t require too-much security tied in the home, the clear answer isn’t really to prevent prepaying the mortgage, its to not ever get as much home to start off with! And you may thankfully, opposite mortgage loans are at least a prospective backup auto to recuperate brand new guarantee right back call at the fresh later years, if it is needed.

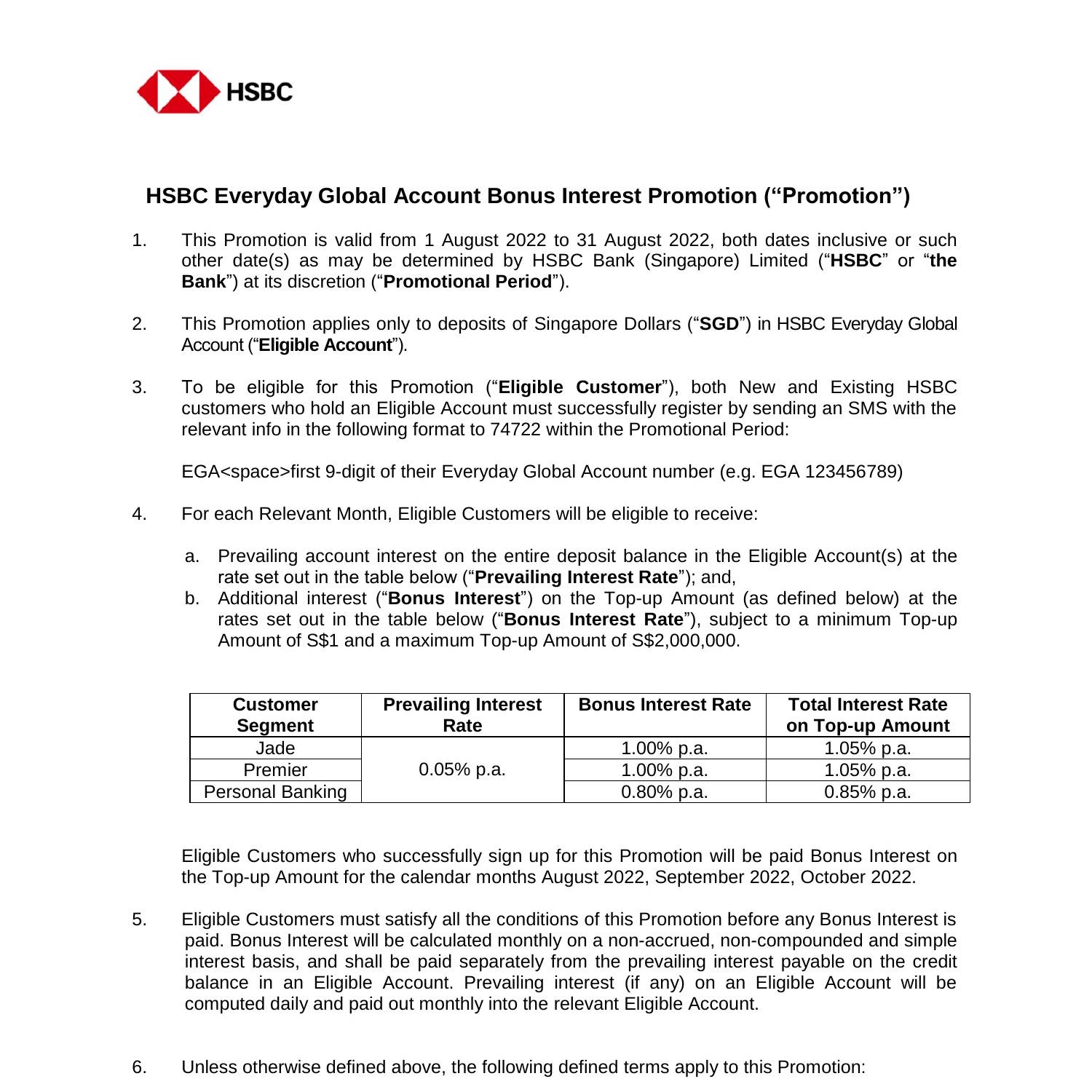

The conclusion, regardless if, is actually to determine that the most recent build out-of mortgage prepayments is actually a poor incentive for all those to truly create guarantee more than and you may past their lowest home loan obligations, because just benefit’ is within the really distant upcoming. Which makes it easier to help you recast otherwise putting some home loan recasting procedure automatic try a significantly better bonus, because provides an immediate prize when it comes to instantly less mortgage repayment personal debt, that is a powerful views process so you’re able to remind wise preserving conclusion. And automated recasting gets the added benefit of reducing losses visibility having mortgage brokers, cutting family cashflow obligations, reducing the dependence on idle crisis deals, and you may providing consumers far more self-reliance and make peoples funding alter (we.age., employment otherwise community changes one demand a short-term earnings setback), whilst and work out property better quality facing unanticipated calamities (age.g., scientific incidents or unemployment or handicap).

What exactly you think? Do you believe automated recasting would be an important added bonus getting customers to blow reduced and you may save a whole lot more? Or are you currently worried it may functions too really, leading men and women to cut effectively, however, feel as well family rich and cash bad along the way? Please display your thoughts on the statements less than!

However, the newest advantage of your own home loan recast if it in the event the lives or monetary factors alter, additionally the debtor needs to build straight down financing costs for a beneficial time frame, he/she’s got a choice of doing this!

Really mortgages today allow borrowers and make prominent prepayments without the punishment. In some cases, this is worthwhile simply because it simply leaves the newest borrower with the autonomy so you’re able to refinance the mortgage that is officially taking out fully a different home loan against the domestic, and utilizing the latest proceeds to fully prepay the fresh old mortgage. Other days, although, the target is basically to have some readily available more funds if or not off a plus at your workplace, a lump sum payment heredity, or just by creating an additional 13 th homeloan payment yearly and you can prepay the main financing equilibrium so you can slow down the number of future financing attention.

Put another way, recasting financing immediately following while making a great prepayment on the it permits the brand new borrower to enjoy all the attention coupons regarding prepayment, while offering greater home cash flow independence in case it is requisite (while the necessary mortgage repayment is lower).

Likewise, having domiciles you to worth liquidity and this seems to be many, given the look into hyperbolic discounting decreasing the monthly financial responsibility reduces the significance of cash reserves in addition to expected measurements of emergency coupons also. That provides a new secondary financial work for once the staying crisis reserves dollars getting 0%, while you have a home loan within 4%, is theoretically a form in the event the bad arbitrage that has a dual pricing (make payment on cuatro% toward mortgage, plus the foregone chance price of new emergency reserves in the bucks).