Knowing the USDA financing approval processes

Immediately following a vague loan system, USDA money are now popular with homebuyers who might have gone with an FHA mortgage.

Whereas FHA need step three.5% off, USDA demands no down payment anyway – and you may financial insurance policy is cheaper and you will rates have a tendency to lower.

But some homebuyers wonder towards USDA mortgage process step because of the action and how brand new USDA mortgage schedule compares.

Just how a great USDA loan performs

USDA mortgage brokers try supported by the united states Company from Agriculture (and that title) to market economic development in rural aspects of the brand new You.S.

However, providing which protected loan does not always mean you must browse out an authorities workplace to make use of. Lenders within the country are supported of the USDA in order to approve these types of loans.

Whenever you can get a keen FHA loan otherwise conventional financial support within a certain bank, chances are it has USDA also.

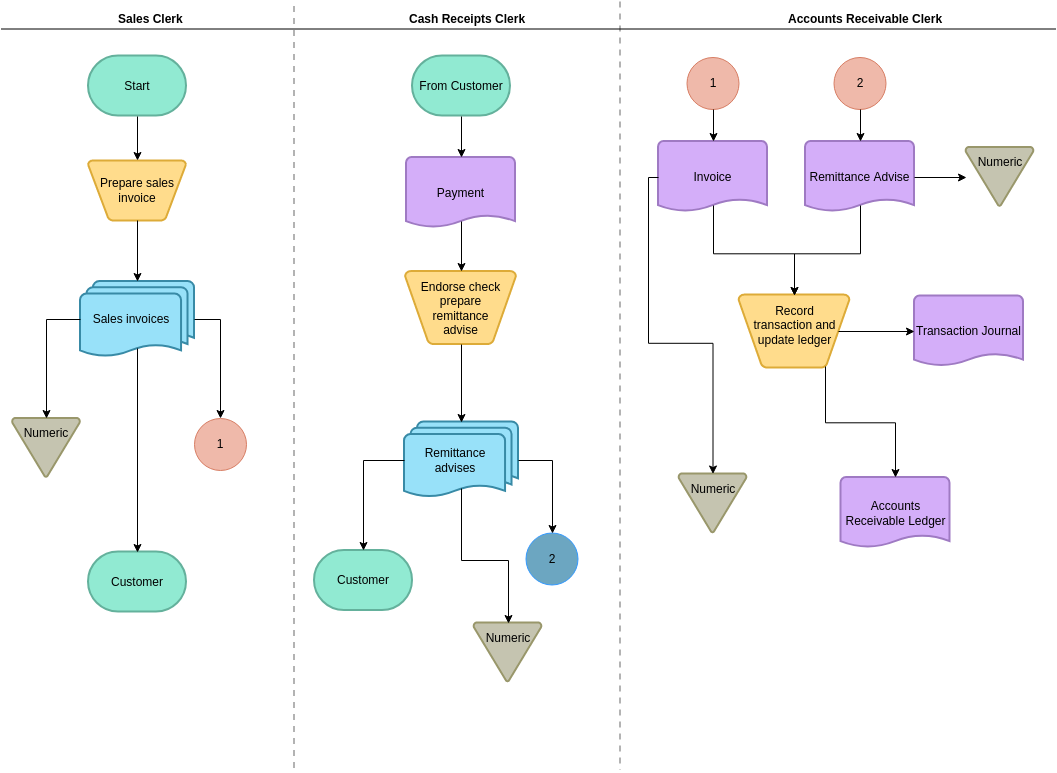

USDA mortgage procedure timeline: Step-by-step

Qualifying getting a beneficial USDA mortgage is a lot like one other type out of mortgage, except having an additional step: Your loan app need to be approved by the USDA.

- Come across and prequalify with a beneficial USDA-accepted financial

- Apply for preapproval

- Pick a home in the a qualified rural area

- Generate https://paydayloanalabama.com/gantt/ an offer

- Go through the underwriting procedure

- Intimate on your new house financing

1: USDA mortgage lender prequalification

Only a few mortgage business be involved in the new USDA mortgage program. And you can individuals who take time for you to find one one to focuses primarily on USDA mortgage loans will find the expertise of use, especially in the underwriting and you will acceptance techniques.

When you prequalify to own a USDA financial, their bank will provide you with an over-all estimate from simply how much you might obtain and you can even if you satisfy qualifications standards.

The loan manager might wish to know your wished amount borrowed, monthly money, and you can month-to-month costs. They could as well as pull your credit score at that very early prequalification stage, too.

Credit score

Your credit rating was a determining reason for determining the interest rates on the financing – the greater your credit score, the better the rate of interest, as well as the reduce your mortgage payments.

So if enhancing your credit score can save you money on your own loan’s monthly premiums, up coming prequalification will provide you with time for you improve their credit.

Because there is zero specialized lowest credit demands so you’re able to qualify for good USDA financial, really recognized lenders need good FICO rating from at the minimum 640.

When your lender possess verified eligibility, you are put up for the next step-in USDA mortgage recognition process timeline: preapproval.

2: USDA mortgage preapproval

Another help the newest USDA financing schedule are a good preapproval. Preapproval are a rigid study of your money in the event the financial will determine the debt-to-income proportion (DTI) and you may be certain that just how much you can borrow on the acquisition price of another type of domestic.

- W-2 forms, 1099 models, and you may tax returns

- Spend stubs

- Financial statements and asset statements

- Societal safeguards number, images ID, or other basic economic information

Getting preapproved for a financial loan was a vital action before you attend unlock domiciles and you can wade house browse. Very providers and you can real estate professionals would like to know they truly are dealing which have a life threatening consumer who has a lender preapproval page inside-hand.

Step 3: See a house inside an eligible town

Because the name itself indicates, the new USDA rural invention loan produces homeownership in the eligible outlying areas for both basic-date homebuyers and you can mainly based borrowers the same.

USDA property eligibility conditions

Yet, of a lot first-go out home buyers try shocked to see how many property are eligible. An estimated 97% of your You.S. land size is considered rural by USDA.