- What your need to know about buying a foreclosed home

- How do home foreclosures performs?

- Type of foreclosure

- Financial support a great foreclosed house

- Cons of buying a foreclosed home

- Lengthy techniques with files

- Household condition concerns

- Competition

- Pros of buying a foreclosed home

- Package pricing

- Financing ventures

- Create wise a residential property assets in partnership with Belong

Discover foreclosed property within the virtually every real estate market in the united kingdom, and purchasing a foreclosed family happens to be smoother pursuing the mid-2000s financial drama. Following the moratorium to your foreclosure, in response for the COVID-19 pandemic, concluded during the , traders expected a boost in foreclosures. Although not, we have been still watching a small also have and tall race. The best added bonus when you look at the to get an excellent foreclosed home is costs, however, volatile timelines, fixes, and solid competition will get discourage you against buying a foreclosed domestic.

You will find several variety of property foreclosure: pre-foreclosure, quick marketing, sheriff’s selling, bank-owned, and you will authorities-owned. The particular property foreclosure possess book characteristics, plus the get techniques may differ. Thought opting for a real estate agent that is regularly the new property foreclosure process. They will be in a position to give you certain insight predicated on the experience.

How can house foreclosures really works?

When an owner can’t build repayments to their mortgage, the bank requires possession of the house. The financial institution usually delivers an alerts out-of standard just after 3 months off skipped money. Will, the brand new homeowner provides the possibility to policy for an alternate payment package for the bank till the house is ended up selling. While you are to acquire a good foreclosed household, you are purchasing the domestic on the lender, not the brand new residence’s original manager.

Particular property foreclosure

Pre-foreclosure: Given that holder is within standard on their mortgage, he is informed by the lender. If for example the homeowner are available the house within the pre-property foreclosure months, they can steer clear of the foreclosures procedure and lots of of affects on the credit score.

Quick transformation: When the a homeowner was long lasting financial hardship, they’re able to Ohio title loans to market their house during the a short deals. The lender should commit to take on reduced towards possessions than what brand new resident already owes on the financial. Brief transformation might be lengthy given that bank needs to work and you may agree the deal.

Sheriff’s product sales: Sheriff’s conversion process is deals kept immediately after residents default on the fund. These deals is facilitated from the local the authorities, and this title sheriff’s product sales. In these auctions, our home comes on high bidder.

Bank-had services: If a property doesn’t offer on public auction, it gets a genuine estate proprietor (REO) possessions. The loan bank, bank, otherwise mortgage trader owns the house or property, and these sort of services are now and again often referred to as bank-owned home.

Government-owned functions: The same as REO qualities, this type of domestic was first ordered using an FHA otherwise Va loan, each other bodies-right back fund. When such qualities is foreclosed plus don’t sell during the auction, it be government-proprietor features. Then, he or she is offered from the agents who do work with respect to new service and this approved the loan.

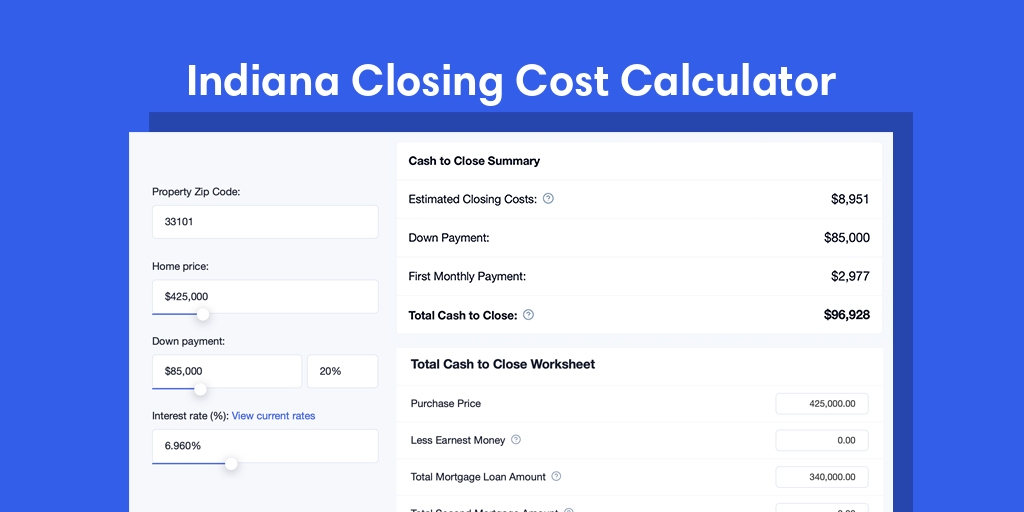

Investment a great foreclosed house

When you’re the cash also offers will provide your most significant advantage when to shop for a great foreclosed household, some money options are designed for resource qualities. Just remember that , individual lenders may be less likely to fund the purchase from good foreclosed household. In order to expedite the method, imagine choosing a loan provider and getting pre-accepted to have an interest rate.

When you find yourself looking for to order a foreclosure, we advice exploring the regulators-backed financing options available to those just who be considered. A great 203(k) mortgage is a kind of capital provided by the Government Casing Management (FHA). There are numerous different varieties of 203(k) loans. You can fundamentally getting charged a home loan top to counterbalance the bank’s chance. You will additionally discover rates for these type of fund go for about 0.25% higher than old-fashioned financing.