What exactly is a debt negotiation loan?

A debt settlement mortgage are an unsecured personal bank loan that you remove to help you consolidate numerous lines of credit credit debt and you can/and other debts with a high interest levels on a single loan, ideally having less speed.

A personal bank loan to have debt consolidating is actually a smart strategy for reducing obligations, saving cash, and you will simplifying everything. Bills in the several metropolises can result in concerns and you can care and attention. Should you get a lesser appeal financing having costs having large attract, you could potentially save on the interest rate. And additionally, handmade cards usually have sky-high APRs, that’s no good on the economic health and wellbeing agency. For those who have numerous mastercard debts, it usually is a good idea to explore what sort of coupons you can acquire having that loan to repay borrowing from https://paydayloancolorado.net/empire/ the bank cards.

How does a debt negotiation mortgage performs? Is actually debt consolidation sensible?

Debt consolidation reduction is the process of using a personal loan to repay numerous personal lines of credit debt and you will/or other expenses. Debt consolidation would-be a good idea whether your mediocre focus speed all over all of your personal lines of credit and/or any other costs is higher than exactly what your personal bank loan focus price might be.

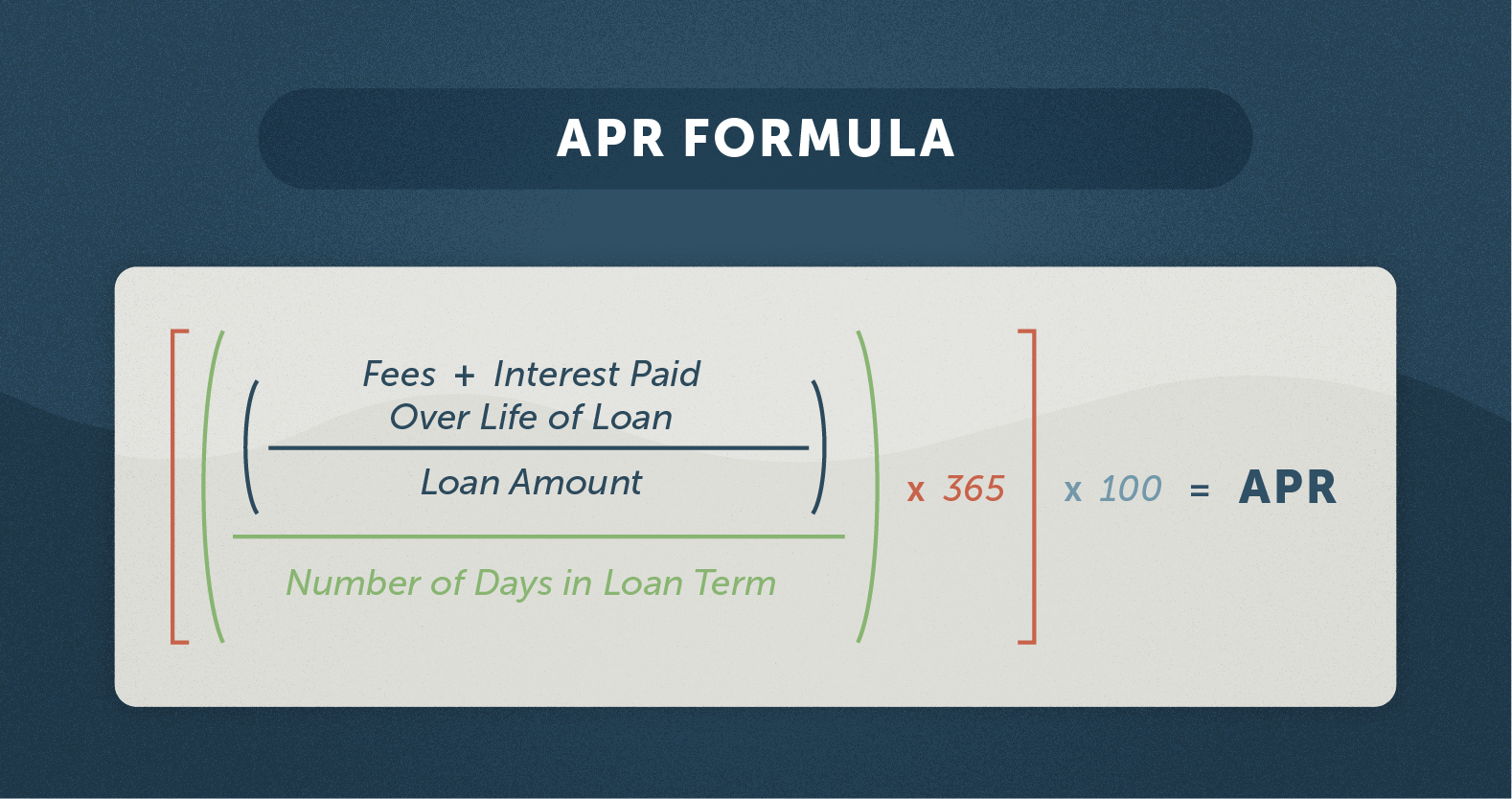

An informed debt consolidating loans security the amount of every of your own mutual debt being pay-off their various other debts upfront, causing you to be which have one simple payment per month. The fresh Annual percentage rate into the a consumer loan for debt consolidating is going to be lower than that your earlier in the day personal expenses and this price will be fixed-not adjustable. Thus, because you pay a financing getting debt consolidation reduction, you only pay a great cumulatively all the way down amount of focus than simply you’d keeps if you had not consolidated your debt.

A consumer loan to own credit debt combination means you to generate one payment per month. That enables you to definitely package and you may budget your daily life with an increase of clearness and you may ease. Financing through Excel is additionally one of the most readily useful possibilities to own debt consolidation reduction as you will has actually customized help towards the name. Do well brings Customer support Advisers who’ve the brand new solutions to support you at every action of your way, and you can a mission to progress your financial well-being.

Would debt consolidating funds hurt the borrowing from the bank?

Your credit score could possibly get lose quite physically once you combine debt. Over the years, however, an accountable financial approach on the debt consolidating can be change your rating.

There are some potential small-name impacts with the borrowing profile that will cause their rating getting quite all the way down initial up on combining obligations with an enthusiastic unsecured unsecured loan.

- Obtaining an unsecured loan to have debt consolidation reduction will require a difficult query to your credit history. This may probably temporarily decrease your rating.

- Paying your borrowing and you will/otherwise obligations outlines have a tendency to reduce the loans you owe and lower your credit utilization ratio (and/or amount of all your balance separated of the contribution of your own cards’ credit restrictions)-a button factor that influences your credit rating. However, a consumer loan is another financial obligation, and you may incorporating another type of financial obligation you certainly will briefly decrease your credit rating.

Everything create just after consolidating that profile exactly how your get change much time-label. For example, for folks who pay down the credit card debt having a combination financing but consistently accrue personal credit card debt, the ensuing collective obligations might has actually a bad borrowing from the bank effect.

Carry out debt consolidating finance assist your credit?

Consolidating credit debt having an unsecured loan may help your own borrowing by reducing your mastercard balances and carrying out increased proportion of readily available borrowing (otherwise exactly how much of one’s available credit you’re playing with)-a special factor that influences fico scores.

A proactive method to debt consolidation reduction will help improve credit. That it involves an extended-title method and a huge visualize goal of enhanced total monetary fitness. Repaying multiple lines of credit and/or financial obligation playing with a keen unsecured personal loan with a lowered speed can reduce the debt minimizing the borrowing from the bank utilization proportion (and/or sum of your balance separated because of the contribution of cards’ borrowing limitations)-key factors which affect your credit score. Purchasing reduced in the focus also may help lower your monthly obligations.

And work out with the-go out costs into credit cards and other expenses is important. A long history of constantly while making money to the-go out is made for your credit score. Debt consolidating money will be very theraputic for their credit profile and your credit rating, however, as long as used since a long-title technique for monetary growth executed with cautious punishment.

Create debt consolidating fund apply to to get a home?

Even if debt consolidating loans apply at your capability to find a property utilizes your schedule in making you buy.

Its essentially not recommended to provide any the fresh new debts otherwise making issues towards borrowing from the bank profile before you buy a property.

However, if you plan to find a house when you look at the a year otherwise so much more, merging your personal credit card debt now because the a strategy to increase the money you owe you will definitely place you when you look at the an excellent updates when the amount of time comes to get a mortgage loan.

Sooner, after you attempted to purchase property you want to make sure to keeps less your general obligations around you can easily and then have spent some time working to evolve your credit score normally too.