Once you refinance you pay off of the financial and you can change it with a new mortgage. When you refinance a home equity loan, you are settling the original mortgage harmony or domestic guarantee line and you may replacement it with a new next home loan or HELOC. When you find yourself refinancing a good HELOC, you may be removing the changeable interest merely costs and changing it on the a predetermined interest mortgage which have a fixed monthly commission.

Before you could shoot for a separate family guarantee mortgage that have a lesser price, you must know precisely what the prospective conditions is actually.

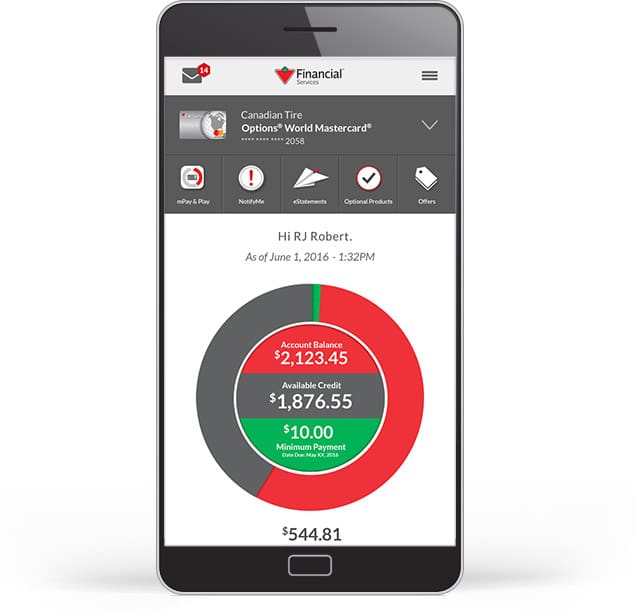

This is basically the straight back-end proportion, that’s a measure of all month-to-month debt money versus the disgusting monthly income.

If you’d like to re-finance to take advantageous asset of lower costs, this will help to boost your credit rating as much as you’ll be able to.

In case your credit score are lower than 700, it’s possible to have troubles qualifying to discover the best cost. A little while the credit rating requirements having HELOCs vary than just repaired rates guarantee loans, so make sure to your bank when you shop 2nd financial possibilities.

How to Lower the Financial Price back at my Domestic Collateral Financing?

Refinancing property equity mortgage involves substituting your mortgage with an alternative one to, maybe to get a lower life expectancy rate of interest, customize the repayment title, or access additional security resulting from your house’s appreciated worthy of.

- Examine today’s rates with the current house guarantee financing rate.

- Reason behind closing costs as if your move them the loan matter increases.

- Evaluate your current monthly obligations into suggested the financing.

- Imagine re-finance domestic security loan rates having fixed rates conditions.

In the course of time, no person can truthfully predict when home loan prices will begin to lose. Whether your cost cited from the house guarantee loan lenders are unsustainable to you, it’s a good idea never to personal loans for bad credit Vermont follow the presumption as possible re-finance later on. The new time try undecided, and also in the new meantime, you chance dropping your residence if you’re unable to match the monthly obligations. Therefore it is wise so you can re-finance your home guarantee loan in the event the you’ve got the ability to spend less having straight down monthly installments and or improve your terms. Identify the best home equity mortgage costs on the web.

Ought i Re-finance a house Collateral Loan to own a much better Terms?

Another option should be to refinance in order to a house equity mortgage with yet another label duration, sometimes longer or smaller, based on if your point is to try to reduce your monthly obligations or expedite financing cost. On top of that, for those who enjoys excess collateral in your home, you have the opportunity to refinance towards a bigger domestic guarantee amount borrowed, enabling usage of extra dollars.

As an example, if you’re refinancing good HELOC otherwise security mortgage that have a balance from $50,000, expect to pay between $750 and $dos,five hundred.

Anytime new charge had been $750, you would need to obtain no less than $fifty,750 if you’d like to move our home collateral mortgage closing will cost you into the latest financing.

Benefits and drawbacks out-of Refinancing property Guarantee Financing

Like most financial decision, choosing to re-finance a property equity mortgage should be thought about meticulously prior to the last phone call. Here are the positives and negatives out of refinancing your property equity loan:

Experts First, you could possibly lower your payment, whenever you be eligible for a diminished interest. Having a lesser rate you will definitely allows you to save considerably into the notice usually.

Next, you could potentially refinance your loan into the a lengthier or less cost term. Using an extended title will reduce the fresh payment but tend to increase focus repayments. In addition you may see a smaller label, and this grows monthly obligations however, decreases attract.