More folks seeking break in to the house industry was sleeping to their applications – by often overstating its earnings otherwise understating their expenses – during the frustration to try and secure home financing, predicated on the fresh studies.

Sean Quagliani, the fresh new co-originator out-of economic technical team Fortiro, which big banking institutions or any other lenders use to help them discover fake data, claims because rates come ascending on a year and you will a great half ago, there’s been a threefold rise in someone sleeping into the household loan applications.

“One example would-be, anyone often personalize a cover slip to boost the level of money you to definitely they’ve got,” Mr Quagliani claims.

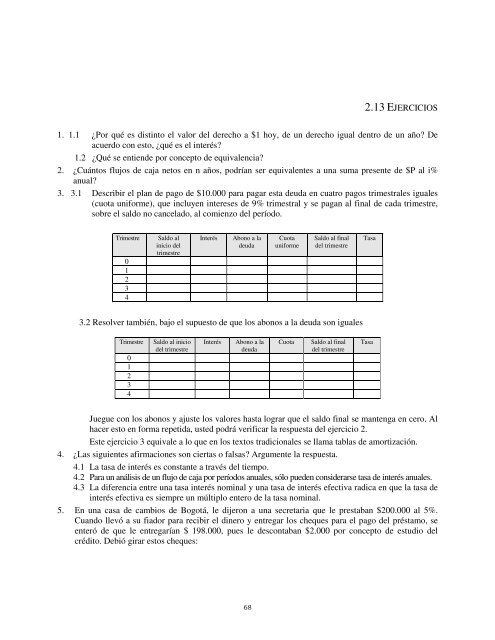

“We come across most other types of anyone deleting purchases off their financial comments to simply reveal that they might don’t have any students, even so they has students. Someone can be quite innovative.”

Sean Quagliani states we have witnessed a threefold boost in someone lying into the mortgage software. ( ABC News: Sean Warren )

Mr Quagliani states a portion of the reasoning there were a keen increase in some one sleeping is because they deal with much better economic tension under rising interest rates, the higher cost of living and broadening home rates.

“For many who put oneself in the sneakers out-of a potential debtor who was trying difficult to get onto the property business and put a ceiling more than its head … its a choice between advising the truth for the lender, and you can probably not getting use of the financing to get the possessions,” Mr Quagliani says.

Doctoring documents or otherwise sleeping in your application for the loan handy link can be void the mortgage deal, causing a standard to your home loan, and can even actually residential property those individuals employed in prison to possess con.

Question more than rising arrears off mortgage cliff

The data appear just like the Set aside Bank for the Friday leftover lift rates of interest to your keep from the its last meeting in 2010.

Economic segments and economists had tipped the newest the brand new central financial do continue cost towards keep in the 4.thirty-five percent inside December, but are anticipating that an alternative rates hike next year you will definitely still getting you are able to.

Put aside Financial Governor Michelle Bullock into the Tuesday said: “there are still significant concerns” and you can “if or not after that firming from monetary coverage must guarantee that rising prices efficiency to focus on during the a reasonable time-frame all hangs abreast of the knowledge”.

More Australians up against rates-of-life style pressures have found they more difficult in order to be eligible for brand new home loans and some is sleeping towards the programs. ( ABC Information: John Gunn )

Particular people who have been caught from inside the a home loan jail try shopping for rescue just like the financial institutions relax pressure screening taken out financial refinancing, however, anyone else are starting to overlook their repayments due to financial stress.

The following year, almost 500,000 far more Australians will strike a mortgage cliff, moving away from reasonable fixed pricing to better variable rates, and come up with their house mortgage repayments unaffordable.

Sector analysts and you may economists predict the fresh costs regarding arrears – that is, individuals shed home loan repayments – tend to spring up along the coming months.

So there are warnings that will, sometimes, end in defaults and you will pressed repossessions out-of residential property after next year.

‘More opportunity’ to produce data

Another reason towards the threefold increase in “liar finance”, Mr Quagliani says, is the fact there clearly was alot more chance to fabricate data files considering the large number of totally free devices available on the net.

“You are not gonna a lender and you can seated in front from people any longer, it’s a highly kind of online digital experience … attainable during the most likely 30 seconds,” he states.

Sean Quagliani says online devices are making it easier for someone to manufacture phony data files. ( ABC Development: Sean Warren )