A loan provider can be inform you if a house you’re considering qualifies, and how much you will likely be eligible in order to acquire. You can then begin the applying processes and commence protecting builder bids into the prepared renovations.

Remember: Needed a thorough builder to help keep your financing focused. Begin searching for you to in early stages, and possess all of them get started on what they do estimates as soon as the you are preapproved to suit your mortgage.

Once obtained completed the newest offers and you will registered just the right documentation, you could send in one last loan data files, personal, and then have happening your own repairs.

As with any mortgage product, FHA 203k money has advantages and disadvantages. Why don’t we view each party of one’s coin.

ProsConsCan make it easier to loans a property purchase and you can solutions with you to solitary loanMore difficult fund that take longer so you’re able to closeMinimal off percentage called for (step three.5% in the event your credit rating is actually 580 or maybe more)Not all the lenders give themAllow one make collateral quicklyComes with an initial and you can yearly Mortgage Cost

The FHA repair loan has many rewards, but definitely check out the disadvantages, too. Remodeling a house are going to be fascinating, nevertheless can also be a giant nightmare if you choose unsuitable company or unforeseen items arise for the repairs.

Whenever how would you like an excellent HUD-recognized 203k agent?

A 203k representative is largely a task director having 203k solutions. They make it easier to file suitable papers and keep maintaining your project and mortgage on the right track while you’re remodeling.

Its not necessary a consultant to find accepted getting an effective restricted 203k loan. But if your framework finances is over $35,000 or you decide to build structural repairs and therefore you want a basic 203k loan, try to work at a HUD-acknowledged 203k agent. All fundamental 203k instructions wanted consultants.

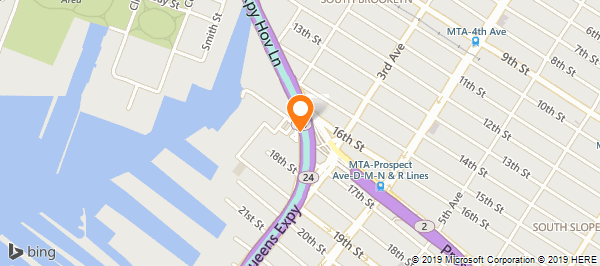

To find an excellent 203k agent, you could ask your financing administrator having a resource otherwise research HUD’s database for experts close by.

FHA 203k financing Frequently asked questions

What does a keen FHA 203k financing coverage? An FHA 203k financing discusses the cost regarding a property, and the cost of qualifying solutions. Into the https://paydayloancolorado.net/crowley/ a small 203k, they’re mostly cosmetic and you can useful updates around $35,000. Practical 203k money allow for large-rates fixes and you can architectural fixes.

How come an FHA 203k mortgage works? FHA 203k financing work such as this: You submit an application for that loan which have a prescription 203k lender. Then you certainly rating bids regarding a skilled specialist, have the home appraised, after which personal on the mortgage. When this occurs, you can start repairs. Men and women should be accomplished within six months, and then you can be transfer to the house or property.

Whom qualifies having an enthusiastic FHA 203k loan? So you’re able to qualify for an FHA 203k loan, you’ll need at the least an excellent 3.5% deposit (having a good 580 credit history or even more). This means step 3.5% of one’s cost plus home restoration costs.

The home might have to see HUD’s lowest property standards, and therefore be sure you might be to shop for a safe and you may habitable property.

What credit history do you need to have an enthusiastic FHA 203k financing? One to depends on their advance payment. Which have an effective 580 credit rating otherwise above, the minimum downpayment to your any FHA loan try step three.5%. In the event your score try not as much as 580, you may need an excellent ten% advance payment.

Just remember that , mentioned are the minimums lay by FHA. Personal lenders can be (and regularly perform) place limits higher than which. You will have to consult your loan administrator observe what credit score lowest you’ll want to satisfy.

Ought i carry out the renovations me personally with an FHA 203k loan? Most of the time, you will need to fool around with an authorized builder to-do the fresh new solutions regarding the a keen FHA 203k loan. Sometimes, you are permitted to Do-it-yourself renovations, but on condition that you can show there is the element and skills to-do work. In addition, you can nevertheless you prefer rates out-of an outside contractor. It is to be sure your own offers is direct.