As opposed to different form of capital options, you don’t have to tell your bank exactly how you are with the currency when taking aside a home collateral credit line. Particularly, when taking out a car loan, you can not pick that you would as an alternative make use of the money to pay down education loan personal debt after you get the money. That have a great HELOC, you are able to the bucks for sets from covering regime expense over a period of economic instability to help you remodeling the kitchen. There are no constraints about precisely how make use of the cash.

Refills since you need They

Along with such as a charge card, you have access to your HELOC throughout the years as you need it providing you continue to shell out your debts. This provides you with a more flexible investment option, as you possibly can can get on several times since you need access in order to more domestic money.

If you are good HELOC loan can supply you with a flexible option for capital life’s biggest requests and costs, it comes down with some factors you will have to know as the newest homeowner. Here are some facts to consider prior to signing on the brand new dotted line.

Higher Cost Than just a mortgage

If you’re APRs to your HELOCs are less than those that you’ll find into playing cards, they are higher than financial costs. When you yourself have an interest rate currently, expect to pay a higher rate of interest than simply your loan if you choose to grab a great HELOC.

Supported by Your residence

In order to be eligible for a beneficial HELOC, you must bring your residence as the equity. This is why one may lose your home for folks who never pay off your own HELOC with respect to the terms of your contract. If you’re one missed percentage into an excellent HELOC wouldn’t bring about the sheriff slamming on the doorway, daily overlooked costs incorporate a significant risk of losing their home to property foreclosure.

Can lead to Overspending

When taking away an excellent HELOC, you are able to basic take pleasure in the loan in mark period. From inside the draw several months, you’ll only need to create desire repayments towards amount of currency you obtain. Thus you could fundamentally invest up to your HELOC’s limitation while also and work out lowest payments equal to smaller amounts away from accrued interest.

Unfortunately, your mark several months would not past permanently. Following mark months ends up, you’ll want to begin making lowest typical payments towards the count of cash you owe, together with accrued appeal. Or even zero your balance anywhere between weeks, desire will continue to material on count you borrowed https://paydayloancolorado.net/seibert/ from, causing you to shell out so much more.

You might have to Spend Closing costs Once again

Identical to after you re-finance, there’s usually an ending process involved with opening good HELOC. However some lenders provides acquired reduce HELOC settlement costs, specific loan providers may charge ranging from 2% and you will 5% of your line of credit harmony in order to execute your own financing availability.

The bottom line? If you find yourself HELOCs offer fast access to help you bucks, you have to be bound to display screen your balance and use finance responsibly. If you’ve had difficulties dealing with their using which have playing cards within the during the last, it might not feel best if you simply take a great HELOC. As opposed to a charge card, your own HELOC financing is supported by your property. If you’re unable to generate repayments on your HELOC, you could potentially are in danger of losing your home so you’re able to foreclosures.

Choosing the right HELOC Financial

Choosing the best HELOC financial are a choice which can significantly perception your financial situation. Always believe situations such as interest rates, charges, customer service, and you may reputation when choosing a lender. Performing thorough lookup and comparing different alternatives, discover a loan provider that suits your specific means and you may provides you with an educated small print for your house security credit line. Usually very carefully opinion every conditions and terms before generally making a last choice, and you can consult with a financial coach if needed.

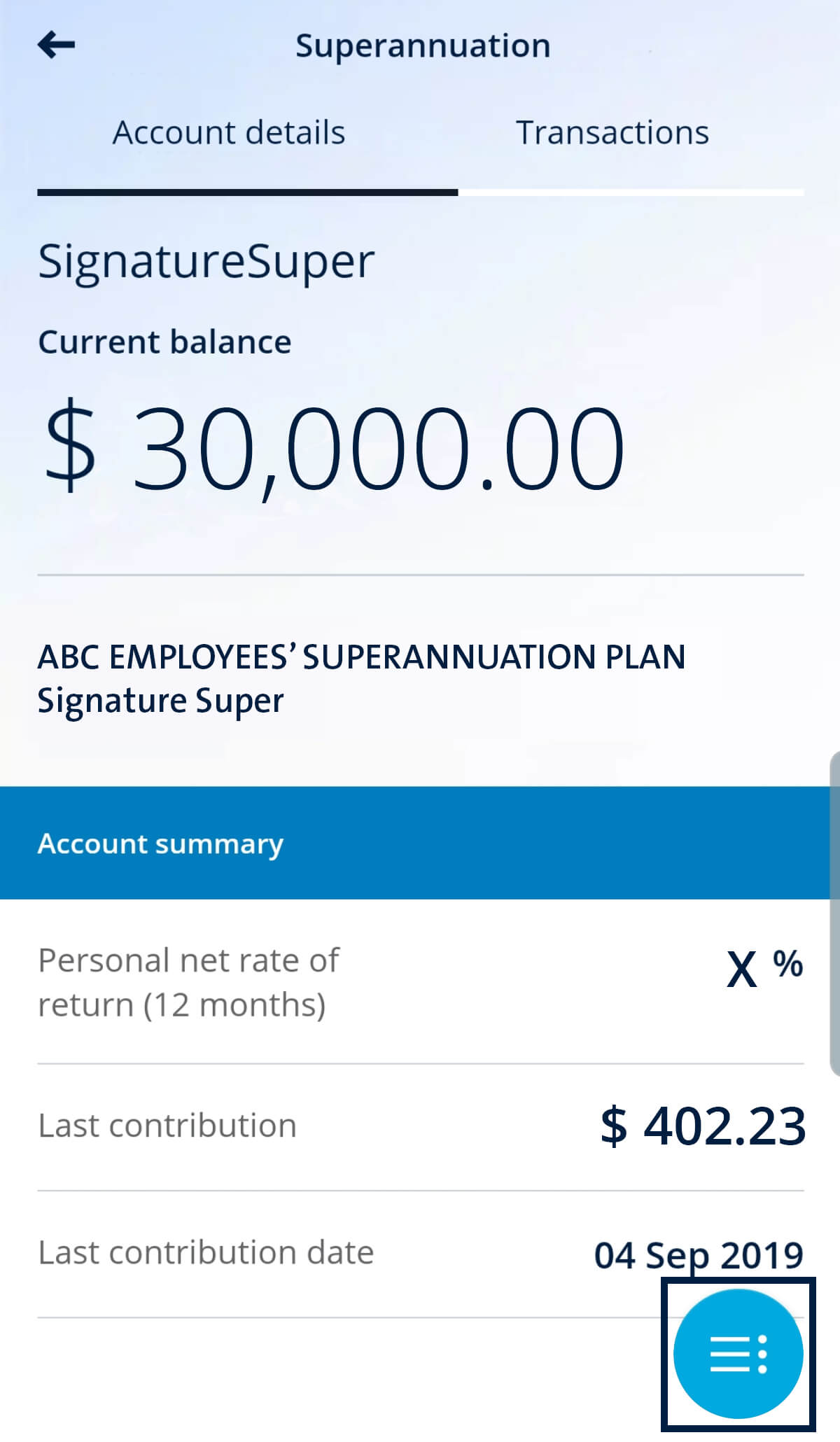

Financial off The united states helps electronic applications and also a cellular financial software which enables you to manage your money and tune your own financing recognition standing on the move. If you find yourself an existing Lender away from America customer, your own personal guidance will seamlessly populate from the form for their HELOC. If you’re selecting calculating the costs of one’s Lender of America HELOC, visit the business’s webpages and make use of their home security varying Apr or home assessment devices. Merely input certain personal information, in addition to systems often calculate the interest rate.