If you’re looking to buy property from inside the an outlying area and you may explore resource choice having good words, USDA money would be a options.

In this article, we’ll walk you through the pros, eligibility requirements, software procedure, and you can dependence on Rural Growth in Lafayette, Louisiana.

Expertise USDA Financing Lafayette, La

The usa Company away from Farming also offers home loan applications backed by USDA money, known as Outlying Advancement financing. He could be designed to assistance homebuyers when you look at the rural and suburban section through providing sensible resource having lower-rates of interest and flexible qualification standards.

Great things about USDA Loan Lafayette, Los angeles

- 100% Financing: USDA finance make it funding for the whole family price, eliminating the need for a downpayment. This will make homeownership a great deal more doable for the majority of buyers when you look at the Lafayette.

- Aggressive Interest rates: Which have USDA finance, individuals can take advantage of competitive rates of interest that will be have a tendency to lower than old-fashioned funds. Lower interest rates change to lower month-to-month mortgage repayments, delivering potential savings along side lifetime of the mortgage.

- Flexible Borrowing Standards: USDA financing has flexible borrowing requirements americash loans Trussville, causing them to available to individuals with smaller-than-perfect borrowing histories. Even though you have obtained borrowing challenges in the past, you may still be eligible for an effective USDA mortgage during the Lafayette.

You can enjoy the great benefits of homeownership without having any burden regarding a deposit, while also using lower monthly obligations and you will better independence into the credit criteria

Outlying Invention Finance when you look at the Lafayette, Los angeles

The necessity of Outlying Advancement: Outlying advancement performs a crucial role during the Lafayette, La, and its own nearby portion. They centers on enhancing the standard of living, system, and monetary ventures inside rural communities.

- USDA Money when you look at the Lafayette: USDA money try a part of brand new outlying invention services during the Lafayette. By providing sensible investment possibilities, these types of finance contribute to the development and you will balances off outlying organizations in the area. They activate monetary passion, promote community innovation, and you will promote entry to as well as affordable housing.

To get qualified to receive a USDA mortgage inside Lafayette, you really need to see specific requirements. Here you will find the trick criteria:

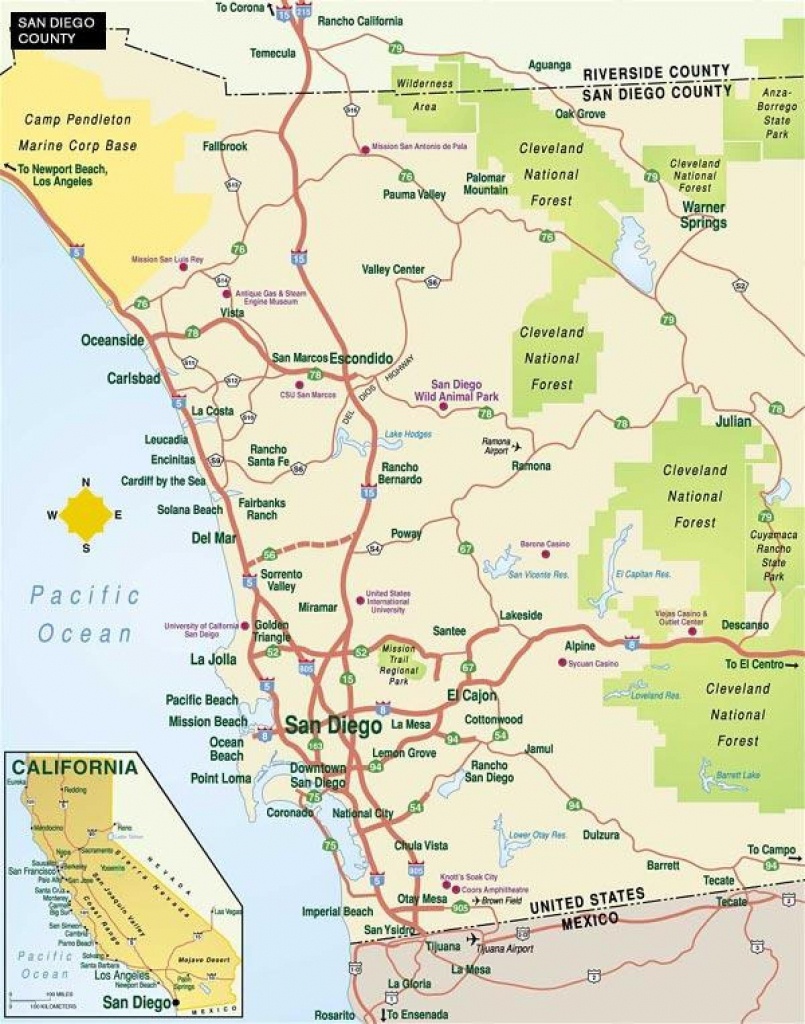

- Property Venue: The house you intend to buy need to be situated in an enthusiastic eligible outlying or suburban city. You might determine the fresh property’s eligibility from the making reference to the fresh USDA qualifications map or contacting a loan provider accustomed USDA fund.

- Money Constraints: USDA funds enjoys income limits in line with the measurements of your house and precise location of the property. Its imperative to review the modern money limitations place from the USDA to determine the qualifications. Such restrictions make certain that USDA fund try directed to the some body and family having moderate in order to low revenue.

- Assets Requirements: The house or property need to fulfill certain safety, habitability, and you will cleanliness conditions established of the USDA. A professional top-notch performs an assessment to test such conditions. They means that the home will bring a safe and you will suitable way of life environment.

Conference these criteria is very important to qualifying getting a good USDA mortgage within the Lafayette. Making certain that the property is within a qualified place, your earnings drops when you look at the specified restrictions, and also the property match the required conditions increases the probability out of protecting good USDA financing. \

Applying for a rural Advancement Financing from inside the Lafayette, Los angeles

- Seeking good USDA-Approved Financial: To try to get a good USDA mortgage within the Lafayette, you will have to find an excellent USDA-acknowledged financial experienced with these finance. They understand this conditions and you can documents needed for USDA financing applications.

- Event Documentation: Before you apply, gather called for papers such as for instance proof earnings, credit score, a career background, house suggestions, and you may identification.