- Take note of the eligibility requirements and you may cost before getting an excellent 2nd property.

- Brand new recent increase in Even more Consumer’s Stamp Duty (ABSD) setting you might you need way more bucks when buying the next domestic.

- To buy a second assets boasts a great deal more monetary duty; it is told becoming clear about your mission for buying the following possessions

With rising prices controling statements into the current months, interest rates are set to rise next throughout the coming months. If you have become gonna to get an additional property, this is a very good time to start appearing once the a good upsurge in interest may indeed imply stabilisation from property costs.

Apart from the cost of the house or property, there are lots of things you would have to be mindful of when to acquire another house, instance eligibility, value and you can purpose.

Qualifications

For folks who own an exclusive possessions, you will then be absolve to pick one minute individual property without the courtroom implications. But not, when your earliest house is a community property, whether it is a create-to-Purchase (BTO) apartment, selling HDB apartment, administrator condominium (EC), otherwise Construction, Create and sell Program (DBSS) apartments, then you will need to fulfil particular conditions before your purchase.

HDB apartments incorporate a 5-year Lowest Field Several months (MOP) needs, which means that you would need invade you to possessions to own an effective at least 5 years one which just promote or rent the apartment. Additionally need certainly to fulfil the fresh MOP till the purchase out-of a personal assets.

Would observe that simply Singapore owners can individual each other an HDB and you will an exclusive assets meanwhile. Singapore Permanent Owners (PRs) will need to get out of their flat contained in this six months of personal property buy.

Value

Attributes are known to become notoriously expensive into the Singapore and you can cautious data need to be made to ensure that your second property get remains sensible for your requirements. You would need to use note of your after the:

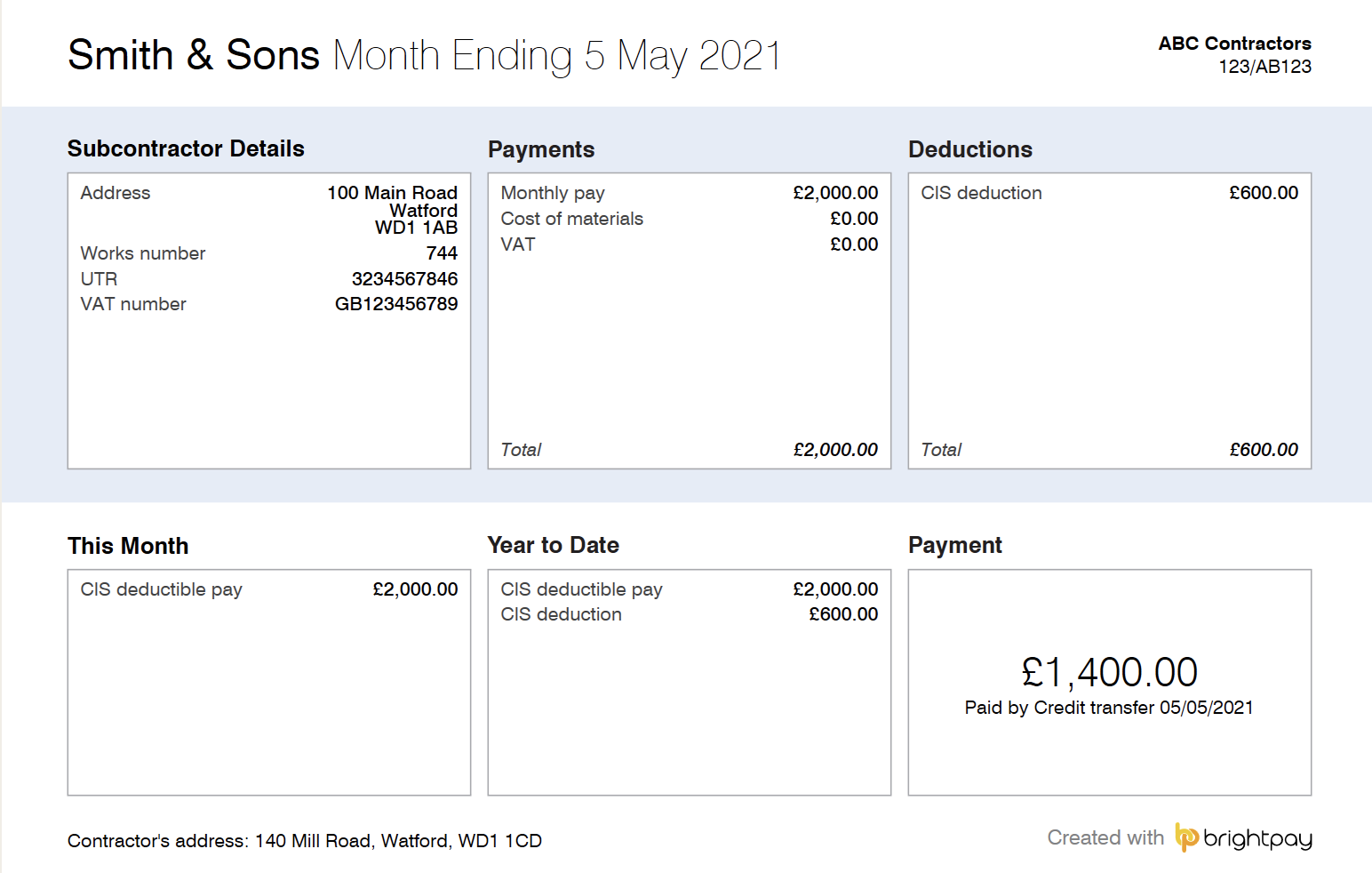

You would have to pay ABSD after you purchase a second domestic assets. Extent you would have to pay utilizes your profile.

New ABSD are history modified for the as an element of measures to help you bring a sustainable property sector. Latest rates is actually shown from the dining table below:

Given the current ABSD costs, an effective Singapore Citizen just who already owns an enthusiastic HDB flat however, desires to find a private condominium charging $one million has to shell out an enthusiastic ABSD away from $two hundred,000 (20%). Carry out observe that it matter is found on the top buyer’s stamp obligations.

Very first house get need only up to 5% dollars down-payment for people who used a bank loan, however your 2nd assets needs a 25% bucks advance payment of one’s property’s valuation maximum. Offered a property that’s appreciated from the $1 million, might need $250,000 dollars to own down-payment.

The full Financial obligation Upkeep Proportion (TDSR) design was delivered onto avoid home buyers regarding borrowing also far to finance the acquisition off a home. According to the framework, home buyers can simply acquire to right up 55% (modified to your ) of their terrible monthly earnings.

When you have a mortgage associated with the first property pick, it does significantly impact the amount you might acquire for the next home. However, if you have currently eliminated the borrowed funds on your own earliest household, then you will only have to make sure your monthly housing loan repayments and additionally various other monthly bills dont exceed 55% of monthly income.

For the very first casing loan, you are eligible to obtain as much as 75% of the house really worth if you find yourself trying out a financial loan or 55% if for example the financing period is more than 3 decades or runs past years 65. For your next construction loan, your loan-to-really worth (LTV) ratio drops in order to forty-five% getting loan tenures doing 3 decades. In case your mortgage tenure surpasses 25 years otherwise the 65th birthday celebration, your LTV drops so you’re able to 31%.

As you can see, to shop for one minute possessions if you’re however buying the borrowed funds of your first house would want alot more cash. Predicated on property valuation out-of $one million, you’ll likely you want:

While it’s possible to utilize the Main Provident Loans (CPF) to shop for the next assets, when you have currently put your own CPF for you very first family, you can just use the excess CPF Typical Membership offers to possess the second property immediately after putting away the present day Basic Advancing years Plan (BRS) of $96,000.

Purpose

Purchasing a moment assets has more economic responsibility than the your first you to, and is also informed to-be obvious regarding the goal having purchasing the second assets. Can it be getting money, otherwise are you presently using it since the another house?

Making clear the mission will allow you to for making particular conclusion, such as the particular assets, together with opting for an area who better match their goal. This really is especially important if your second house is a good investment property.

Like any almost every other opportunities, you’ll need work out the possibility local rental give and you may capital prefer, in addition to influence the fresh new estimated profits on return. As the a house get is a large resource, it’s also wise to features a strategy one to consider things such as for instance:

What exactly is your investment loans in Clayhatchee vista? Do you really seek to bring in a return just after 5 years, or perhaps to hold on to they with the a lot of time-name to gather book?

Whenever and exactly how do you realy slash losings, if any? If for example the home loan repayments is more than the low local rental earnings, the length of time do you really wait prior to attempting to sell it off?

To find a home into the Singapore are resource-intense and purchasing another family will require significantly more financial prudence. People miscalculation might have significant monetary consequences. Therefore, set up a definite bundle and demand an abundance thought manager so you can with it is possible to blind spots.

Start Believe Today

Here are some DBS MyHome to work through the newest amounts and acquire a property that suits your budget and you may choice. The best part it slices out of the guesswork.

Instead, ready yourself having an in-Principle Recognition (IPA), and that means you has actually certainty about how precisely far you might acquire having your property, enabling you to discover your financial allowance accurately.