The fresh new calculator below estimates enough time needed to shell out straight back no less than one debts. While doing so, it provides pages more rates-successful payoff succession, into the option of including additional costs. This calculator makes use of the debt avalanche strategy, experienced by far the most rates-productive benefits approach regarding a financial angle.

Money and you will expense is first financial points in modern societypanies, someone, and even governing bodies assume debts to steadfastly keep up operations. The majority of people will need on some funds in their existence, whether it’s mortgage loans, figuratively speaking, automotive loans, personal credit card debt, or any other debt.

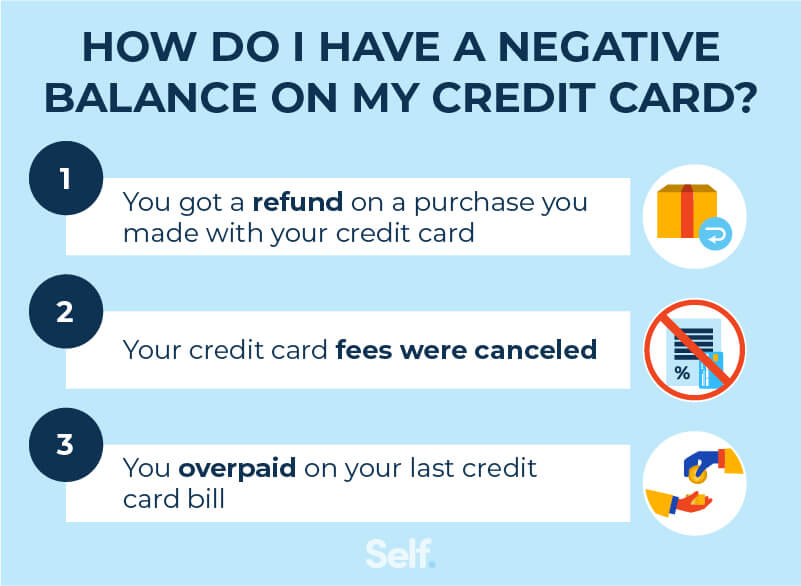

If the used responsibly, costs might help somebody very own home, get vehicles, and continue maintaining its lives running. not, obligations also can bring about large levels of stress. This can bring about big rational, bodily, and you may medical and health factors over time. And, excessively bills, particularly personal credit card debt, normally encourage people to overspend, charging all of them a great deal of profit notice expenditures.

Pay-off Costs Very early

The majority of people such as the feeling of becoming obligations-free and you will, if at all possible, will pay away from costs before. One well-used way to pay off loans more readily is always to create additional payments in addition required lowest monthly payments.

Individuals can make one-go out most payments otherwise shell out a lot more numbers every month otherwise 12 months. Those individuals additional money commonly reduce the dominating numbers owed. They also circulate the rewards time give and reduce the total amount of great interest paid back across the life of the borrowed funds.

The debt Incentives Calculator over normally fit a-one-time even more percentage or multiple periodic even more payments often by themselves or shared.

Before carefully deciding to repay a loans very early, borrowers should find out when your loan means a young rewards penalty and you can have a look at whether paying that financial obligation shorter was an effective good notion economically.

And work out additional repayments with the financing can help, its too many normally, in addition to options costs are entitled to attention. By way of example, an urgent situation financing may bring assurance when incidents instance medical emergencies otherwise motor vehicle collisions occur. Moreover, holds one work while in the a great ages could possibly offer an elevated economic work for than a lot more payments towards a minimal-attention debt.

Conventional facts provides it that individuals is always to pay-off large-focus bills particularly charge card balances as quickly as possible. They need to then see its financial items to determine in the event it is reasonable and also make more payments with the lowest-notice debts for example a mortgage.

How to Pay-off Bills Very early?

Once consumers propose to pay off debts very early, they might struggle to act. Reaching including a goal typically takes enterprise monetary punishment. Finding most financing to settle the fresh costs constantly concerns measures including undertaking a spending plan, reducing too many paying, attempting to sell undesired facts, and you may changing one’s life.

Consumers must also utilize the best strategies to pay off the costs. Here are some of the most preferred processes:

So it debt installment method leads to a minimal complete desire costs. It prioritizes the new cost from bills with the higher interest levels if you’re paying the lowest needed amount for each and every almost every other debt. So it continues instance an avalanche, where high interest rate debt tumbles down seriously to another higher interest rate personal debt through to the borrower pays off most of the loans and the avalanche comes to an end.

Simply put, credit cards with an enthusiastic 18% rate of interest gets priority over an effective 5% financial otherwise twelve% personal bank loan, whatever the balance per. The debt Payoff Calculator uses this process, along with the results, it instructions expenses from top to bottom, starting with the best interest levels earliest.