While the mark several months finishes, the latest payment months initiate. You will be guilty of and work out notice and prominent loan money during the which phase.

- Qualifications conditions. No matter if qualifications conditions will vary, extremely lenders wanted individuals having a credit score, debt-to-income (DTI) proportion, and you can income. So if you’re offered applying for a house equity loan, HELOC or cash-out re-finance, needed some security of your home.

- Amount borrowed. Limitation loan numbers and vary because of the lender. Whenever choosing a home update financing, make sure the financial offers a loan amount https://paydayloanflorida.net/lutz/ that matches your borrowing from the bank demands.

- Installment terminology. Additionally you have to discover a choice that gives a payment name that fits your circumstances. Eg, a lengthier fees term typically is sold with a diminished payment per month. However, a major disadvantage would be the fact possible spend far more notice over the life span of your own loan.

- Charge. The type of fees billed hinges on our home update loan choice chosenmon personal loan fees were origination charges, later fees and prepayment punishment. In addition, for people who tap their home’s guarantee to cover home improvements, you may need to spend settlement costs.

How to Submit an application for a house Improve Mortgage

- Regulate how far you would like. Imagine the cost of your house improve venture to find the loan amount you need to consult.

- Review your own borrowing. Lenders basically remark your credit score once you connect with assess just how more than likely you are to repay the loan. Review their credit reports out of all around three credit reporting agencies – Equifax, Experian and you may TransUnion – to own discrepancies by going to AnnualCreditReport.

- Contrast the options. Weigh advantages and you may cons of several capital choices to come across one which suits your position.

- Lookup and examine lenderspare pricing and terminology away from multiple loan providers so you can get the very best deal. Cause of a full price of the borrowed funds, and additionally any costs, cost, etc.

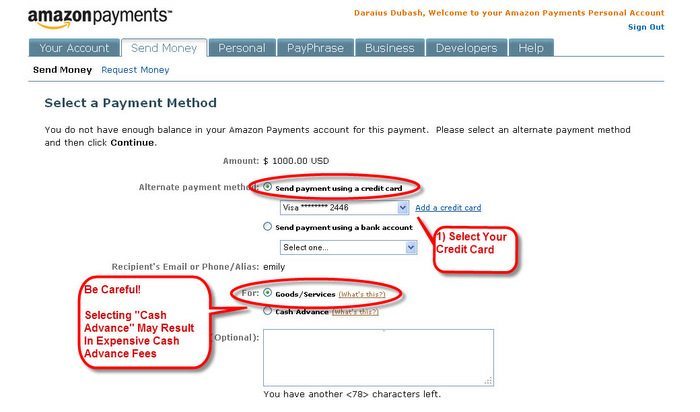

- Fill in a software. Once you’ve chosen a lender, the past step is to utilize for a loan. You’ll likely need to render individual and you may monetary information, just like your Personal Cover number, tax statements and you may W-2s.

Conclusion

Trying to find property improve loan which fits your unique need means browse and you can think. Consider eligibility requirements, mortgage quantity, and you will financial support rates when you compare the options. Before you apply for a financial loan, contrast costs and terms out of as numerous loan providers that you can to get the best offer you’ll be able to.

Faqs

Financing quantity are very different of the lender, the option you choose, and your book financial situation. Specific lenders offer consumer loan amounts between $step one,one hundred thousand so you can $100,one hundred thousand. Extent your be considered so you can obtain depends on your own creditworthiness.

Household security mortgage and HELOC lowest credit score requirements are different, however some lenders has lowest credit rating conditions as low as 640. Personal loan credit rating standards vary because of the financial but could feel as low as 600. The greater your credit rating, the higher your chances try off being qualified and you may protecting an aggressive interest.

Cost terminology vary because of the financial. An unsecured loan typically has that loan title out-of a couple to five years. House guarantee money features payment terminology one to include five to three decades.

It depends to the sort of mortgage applied for. When the a citizen uses a house equity financing to cover renovations, they are able to so you’re able to allege an appeal deduction. However if they use a personal loan to cover home improvements, they’re not entitled to a beneficial deduction. Consult a taxation top-notch to see if your house improvement financing qualifies.

Once we strive to the all of our research, we do not always offer an entire set of most of the available even offers out of borrowing from the bank-credit businesses and you will banking institutions. And because also provides can change, we cannot make certain all of our pointers will still be to big date, therefore we remind you to make certain all the fine print of any economic equipment before you apply.

Upstart

With this lender, you certainly will spend an origination percentage anywhere between step one.85% and 8%. Borrowers can observe its rate before applying instead impacting its credit score.

Some other improvement is that a HELOC have one or two payment periods: a blow period and you can an installment several months. From inside the draw months which persists a decade, you could withdraw as much currency as you need to your own credit limit. Together with, while you are throughout the mark period, some lenders is only going to require you to build attract-just payments.