Cutting-edge CRM Enjoys To possess A smooth Feel

- Track and do top honors process.

- Consider money accrued.

- Song conversion process, feedback show and you will build relationships users.

- Recommend website subscribers for other lending products immediately.

- Enhances customer transformation, nurturing and you will maintenance having instantaneous studies retrieval and you may help possess.

- Full accounts.

- Complex statistics and you will knowledge.

07.How can i efficiently manage and track the brand new condition of your own prospects?

Anyone hopes for purchasing his personal family. A home is the most costly advantage a guy expenditures within his or their whole lifestyle. The value of your house is approximately 5-8 minutes the fresh new yearly income men and women thus some one you need a monetary choice to purchase a property.

Which finance services one banks and you may financial institutions promote are a good home loan. A mortgage fundamentally funds you having a lump sum payment equal so you can otherwise less than the value of your residence and thus enabling you create the purchase. It matter are reduced by the someone back once again to banking institutions otherwise creditors with attention. . Read more

Delivering financing of a financial otherwise a financial institution try maybe not an easy task. It will require many papers, several go after-ups and you can experience with some options available. Home financing representative tends to make this task of going property loan simpler for you.

Who is home financing Broker?

Home financing agent is actually a man or woman who makes it possible to throughout the the procedure of providing a mortgage from initiation toward last disbursement of cash for you. Most of the bank and you can lender have subscribed individuals who function as financial representatives. Specific financial agents is freelancers and are generally perhaps not of this one creditors.

A mortgage agent provides the expected sense, degree and you will understanding of various alternatives for providing home financing and can guide someone otherwise people to decide a suitable house financing option that is suitable according to its financial situation and you can standards.

When you fulfill a mortgage broker, they go using your borrowing profile, ensure you get your credit history report and make the total amount from mortgage one tends to be eligible for and differing choices one to clients may take the house loan

Generally, financial agencies satisfied website subscribers really and you may helped you when you look at the whole casing loan procedure. However, recently, countless mortgage agent come very nearly at any point in time in helping customers employing inquiries. Therefore, website subscribers can apply having mortgage brokers online also on the help of home loan agencies

That will getting a home loan broker?

Within the India, one Indian citizen over the ages of 18 that have the absolute minimum degree of twelfth amount is eligible being a mortgage representative.

Apart from the minimal knowledge qualification, its asked you to mortgage agencies are perfect at the interaction and you will networking enjoy.

The ability to learn selection, empathize having subscribers and you can salesmanship also are the brand new attributes off an excellent financial agent. To-be home financing agent is additionally an area-community of many people that demands no investment therefore.

Advantages of To-be Casing Mortgage Broker which have Options Hook

One aspiring to become a mortgage representative means new correct platform in order to find out different aspects of household money and arrived at to connect which have clients from various edges of the nation

Choice connect try a varied economic conglomerate one to allows people to end up being mortgage representatives instructed because of the best financial institutions. Check out of the experts you to Choice Link will bring in order to the new table:

Generate a different sort of income source for lifetime- Associating with Choice Connect helps you become a mortgage agent that last with a passive income source to possess a life.

Flexibility The latest paperless and you can advanced screen within Choice Hook up can help you with the flexibleness to help you carry out functions from anywhere Chase installment loan no credit checks no bank account and whenever according to your convenience.

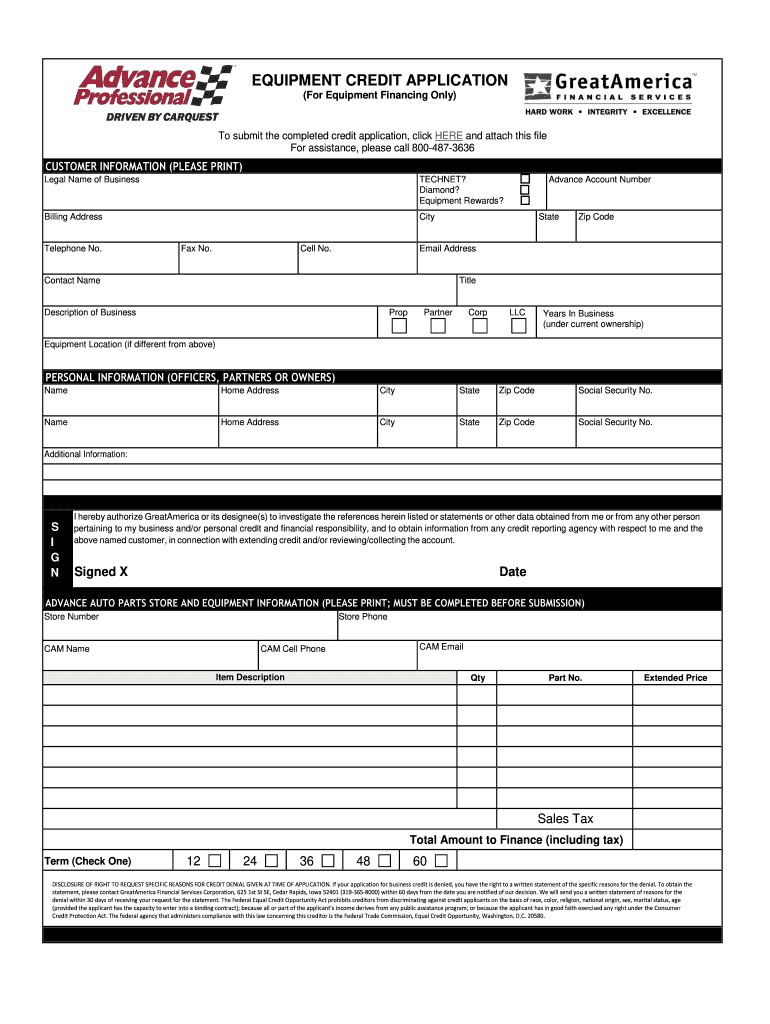

Usage of advanced CRM Choices Hook enjoys committed to a premier-high quality CRM that will help home loan agents’ track all of their guides towards a bona fide-go out foundation to assist agencies for the workflows each and every and you can the client at a click off a computer key.

Clear with no Deposit Multiple associations inquire about deposits to be mortgage agencies. Alternatives Connect is one of the partners trusted labels on sector that helps you become a home loan broker without having any profits and helps your work in an entirely clear style.

How to be Financial Broker

Different networks provides some other strategies to join up as a home loan agent. As home financing agent towards the Choice Link Program are most simple and easy the procedure constitutes 4 actions:

As smartphone and you can email address are confirmed, you need to enter into their earliest guidance as well as your target. In this step, be sure so you’re able to type in their Permanent Account Amount of Pan.

Post serving the essential pointers, you need to include your own term facts and you can publish a flaccid content of the identity evidence.

Once your data files try uploaded and you will verified because of the Solutions Connect, youre ready to go and you will log in to the device and start taking advice.