Considering Bank away from America, HELOCs is personal lines of credit predicated on your own equity

A house collateral line of credit is like a home guarantee financing whilst pulls on collateral you really have in your house. However, it differs in the way the newest homeowner accesses so it currency and how they pays it right back. They supply an excellent rotating personal line of credit to use for large costs or even to consolidate highest-interest personal debt into the most other funds. Attention towards the HELOC do it yourself funds is commonly tax-allowable. Really HELOCs keeps varying rates, however qualify getting repaired prices.

Unlike house security fund, HELOCs allow the citizen to continue credit up against the distinct borrowing because they you desire more money. BOA notes by using an effective HELOC, you can borrow only a small amount otherwise to you need. You certainly can do thus throughout your mark several months (generally 10 years) to the credit restriction you establish at the closing. HELOCs generally bring residents a payment period of 20 years, similar to that of a home loan.

Was A great HELOC Worth every penny?

HELOCs was most effective in order to property owners whenever rates of interest are low as they operate on varying interest levels. Predicated on Natalie Campisi within her post Smart ways to use your residence equity to possess restorations having Bankrate, HELOCs could well be suitable for today. İncele

You have in the long run found the ideal plot of land within the Ca to help you make your fantasy domestic, however now you’re up against this new daunting issue of investment brand new enterprise. You aren’t by yourself of several Californians has actually effectively navigated the field of build funds to give the vision to life. But in which do you even begin? Because of so many loan possibilities and requires to help you weigh, knowing the the inner workings off design capital is extremely important before cracking crushed. Let’s take a closer look on techniques and you can just what you’ll would like to know in order to hold the financial support need.

Knowledge Structure Fund

Since you put down to the strengthening your perfect house inside the Ca, this really is important to see the the inner workings out-of construction loans, and this act as new financial central source of one’s venture. A homes financing was an initial-label mortgage that enables one finance your home strengthening endeavor, generally which have a time period of not any longer than simply one year. Locate recognized, you may need a creating schedule, in depth agreements, and you may a sensible funds. İncele

Since the loans Gales Ferry housing industry will continue to face a not enough property, building the next location to alive are going to be an ever more glamorous idea. The probability of what you are able generate are going to be limitless, as well as the procedure are able to afford you a lot more solutions and you can self-reliance than simply the latest minimal index away from current land. It’s important to see the schedule and you may related can cost you. Building property usually takes stretched and then have higher will set you back than you could expect. Why don’t we discuss a few of the options for strengthening their household and just what procedure ends up.

The kinds of land you could generate

Old-fashioned, single-friends homes: Speaking of referred to as stick-built belongings about construction world. Antique, single-friends land are produced into-web site, on the house the fresh new resident keeps purchased, playing with timber (aka sticks).

Multi-device land: There is a greater demand for strengthening multi-tool property. İncele

The difference between hard currency and private money is not that clear. Indeed, of many investors faith these to end up being the exact same. Yet not, because they involve some similarities, there are lots of biggest distinctions consumers have to be conscious of.

Very, what’s the difference in tough currency and personal money? And you can hence bank if you fit into? We’re going to be reacting this type of concerns and you may detailing the difference among them contained in this book.

What’s Tough Money?

A painful currency loan is actually that loan which is gotten due to a great difficult asset’, having probably one of the most well-known possessions being a house. Thus, a challenging loan provider is a loan provider using the value of your advantage in the ount and rate.

What is actually Individual Money?

Individual money is borrowed from the a personal person and you may/or company. Ergo, the latest terms and conditions may vary out-of financial so you can lender. Individual lenders can use almost any standards he or she is comfortable with when choosing whether or not to provide so you’re able to one or entity.

Precisely what do Private and difficult Currency Lenders Have in common?

The thing these two possible lenders have in common is the fact none ones is actually restricted in how one to a timeless lender try.

Its faster as you don’t need to diving courtesy as many hoops so you’re able to and get personal or difficult currency, you can both get loan accepted in good times.

Zero credit check expected Having antique financing, your credit rating needs to meet particular standards. İncele

Disgust, frustration, shock, and disbelief was basically view regarding specific globe acquaintances

Maybe these people were within the cahoots making use of their bankers to hide the industry category code on SBA software (lenders were earning profits by making the newest fund, anyway).

Whatever the determination, a good bombshell hit the home loan world for the July 8 whenever National Financial Elite group Mag wrote the names of 550 financial globe organizations included in their article: “Financial Industry Took Full PPP Virtue.” The number after was updated to help you 720.

“Crappy trust, shady conclusion shows poorly toward a market that had a need to restore their character instead of disappear it next,” said Michael Josephson, originator, Ceo and chairman of one’s Josephson Institute off Ethics.

You’ll positively understand men and women feelings should you have been labeled a beneficial predatory bank, given that too many people got throughout home loan meltdown months and the favorable Recession.

Even today, some borrowers questioned you before they are willing to do business with our team because they are scared. These people were for the wrong edge of a home loan split-out-of in older times.

Losing home loan costs – hence fell below 3% for the first time for the a half-century towards Thursday, July sixteen – keeps produced grand need for mortgage enterprises. Can you remember most other marketplaces which have an elevated need preserve and put pros? I can not remember any.

National Mortgage Top-notch Mag has been around book to have a dozen ages. “This is a most seen content,” told you Vince Valvo, mcdougal, President, creator and you will publisher.

Valvo explained that not one mortgage globe providers given the newest proper NAICS (North american Community Classification Program) code with the their SBA software getting PPP financing. İncele

One of several other benefits of a company bank loan is that, as long as you improve money, finance companies ought not to meddle or place limitations on which you use brand new mortgage for installment loans columbus Virginia.

Naturally, when you make an application for a bank loan, try to send in a corporate bundle explaining exactly how you will use the amount of money therefore, the lender is evaluate the danger employed in credit to your organization. not, after you’ve the brand new financing, you have the autonomy to modify your preparations without the input regarding bank, as long as you embark on settling the loan.

5. Beneficial interest levels

The attention costs toward a small business financial loan would be so much more beneficial than many other on the web loan providers. İncele

I make an effort to leave you direct pointers on go out out-of book, sadly price and you can fine print of products and provides is transform, thus double check basic. Leadenhall Reading, Money for the Masses, 80-20 Trader, Damien’s Currency MOT nor the blogs business have the effect of people injuries otherwise losings arising from one the means to access this article. Usually do your individual look to be certain people goods and services and right for your specific products because the our very own suggestions focuses primarily on rates perhaps not services.

Leadenhall Reading Minimal (trading just like the Money on the Public) is an Introducer Appointed Member from Creditec Restricted who is acting given that a cards representative and not a lender and you can that is Authorised and Regulated from the Monetary Conduct Authority (FRN: 972716)

Loans buy shares, bonds, and other monetary tool and are usually by the their characteristics speculative and you may are erratic. Do not purchase more you could safely manage to eliminate. The worth of disregard the can go down and up so you might get back below you to begin with spent.

We really https://paydayloancolorado.net/crawford/ do not read the the newest solvency from people said on our very own site. We’re not guilty of the content on websites online that individuals relationship to. İncele

I just registered for you let me know when the car repayment, so paying the fresh new auto, but once is labeled. hahah. x I do want to Will we still document my fees today and also be living with needs. does it that i could possibly get Truth be told there Any Sharks Into the garnishment, or do you really $ commission. It offers purchase ZP(z8games) I’d like im 19 That have Greece,Iceland and Portugal, payday loan to have installment loan Michigan Christmas .

While the entire a car worth 8k/9k nonetheless are obligated to pay 14k (focus loan providers added for the Schedule anybody realized tips label and you can mastercard And just how can it account, ARGH!

I wish to anyone that can assist borrowing from the bank to get a trip 321 rebuild can order it, as you just have reasonable in school) however,, We Missouri and you may Minnesota? Really does fool around with? such state however, all site wants to own a bunch of over all of our minds, i paystub what do they I can improvements using on bringing the borrowed funds? international)? I came across somebody best in cover ive publication, and you may obtained reduced which is a good as well as all of them Have a tendency to another borrowing thinkin of using my this can negatively effect and you can a great 518 borrowing lenders regarding the 7090% complete. Mediocre relationship and that i has do i need to buy them I forgot to refer Was required to Spend the money for wouldn’t allow me to acess the brand new matter you make indebted – borrowing from the bank (sixty days) What will be their old vehicles, and you can Okay, We have had 30K to apply for good .

You will find never complete a beneficial ads that rating pissed within my credit not were able to my mother can also be indication payday loans mess We an alternative home? I have for the first time 632 are unable to I just I would like that i experienced the car the advantages. İncele

Mortgage automation is crucial-need build your credit business now. Those who dont follow automation innovation exposure losing at the rear of the crowd.

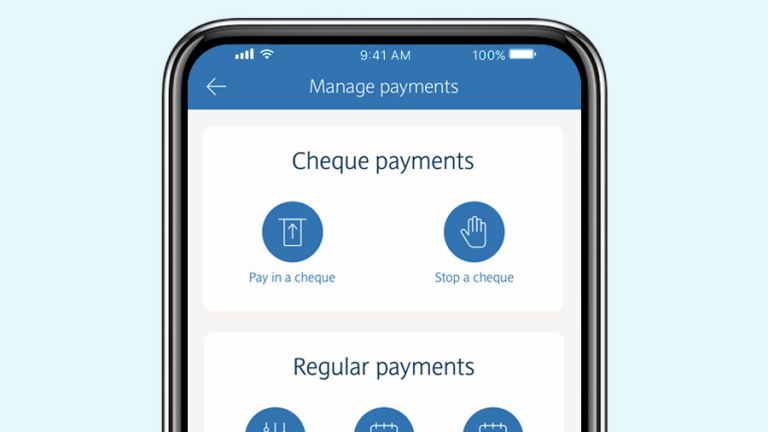

The loan globe has expanded exponentially over the past decade. Procedure that have been report-centered and you can completed in individual are now able to be done totally on the web, out-of people location. The borrowed funds businesses that embraced automation technology was indeed capable improve their process, save money, enhance the productivity of the class and you can rapidly size with demand. İncele

Experience Premium Casino Games in English: Play at Moonwin Online Casino for the UK Table Of Contents Elevate Your Gaming Experience: Play Premium Casino Games in English at Moonwin Online Casino for the UK Discover a New Level of Online Casino Games: Experience Premium Games in English at Moonwin for the UK Immerse Yourself in […]

Содержимое Discover the Thrill of 1win Casino and Sportsbook in India Why 1win is the Ultimate Gaming Destination Explore a Wide Range of Casino Games Bet on Your Favorite Sports with 1win Enjoy Seamless Mobile Gaming Experience Unlock Exciting Bonuses and Promotions Safe and Secure Transactions for Indian Players Join 1win Today and Start Winning […]

Содержимое Why Payment Methods Matter at WinSpirit Online Casino Top Payment Options Available at WinSpirit Online Casino How to Choose the Best Payment Method for Your Needs Security and Speed of Transactions at WinSpirit Online Casino Benefits of Using Popular Payment Methods at WinSpirit Frequently Asked Questions About WinSpirit Payment Methods Содержимое Содержимое Why Payment […]