Owning a cellular house in today’s world can be a cost-effective way to enjoy homeownership. However, if you have bad credit, it might seem you to acquiring a mobile financial is going of your question. Many people deal with borrowing challenges because of past financial hardships, particularly later payments, large loans, or even case of bankruptcy. These issues can also be significantly impression credit ratings, so it is harder to help you secure beneficial mortgage conditions. But not, it’s required to observe that bad credit doesn’t necessarily suggest your can’t see home financing.

Will still be you can easily so you can safer less than perfect credit cellular lenders. Within this step-by-action book, we’ll walk you through the whole process of securing mobile household loans with bad credit.

Step one: Look at your Credit history

Before you start obtaining mobile lenders, it’s important to discover where you stand credit-smart. Get a duplicate of one’s credit history away from the about three major credit agencies: Equifax, Experian, and TransUnion. Review your credit history when it comes down to errors otherwise discrepancies that might end up being hauling down your credit rating. Conflict people inaccuracies you notice to alter your own borrowing from the bank profile.

2: Replace your Credit history

When you find yourself boosting your credit rating takes some time, it is really worth the energy that you can end up in best mortgage conditions and lower interest levels. Here are some measures to assist improve your credit history:

- Shell out their expense timely: Constantly and also make on-date payments is one of the most effective ways to improve your credit rating.

- Treat charge card balance: Large mastercard balance according to the credit limit is also adversely effect your credit score. İncele

CalVet Mortgage brokers

You will find the fresh new CalVet Mortgage will save you money and offer safeguards for your home and you can resource. CalVet has exploded qualifications so that very pros (along with those today into energetic duty) trying to buy property inside Ca are eligible, subject to monetary degree and offered thread fund (pick limitations to possess peacetime-era pros).

Lots of pros to shop for property inside California are eligible having a CalVet Financial, also veterans whom offered throughout the peacetime. Only 90 days away from energetic obligation and you can release classified due to the fact Honorable otherwise Lower than Respectable Standards are essential. Recommendations to ensure how to get a loan New Union your qualifications is actually uncovered on your Certificate regarding Launch or Release off Energetic Obligations Setting DD214. Experts currently to the energetic duty meet the requirements after offering the 90-go out productive obligations demands. A statement off Solution from your latest command is required. Newest and you can previous people in the new National Guard, plus You Armed forces Supplies, are qualified because of the conference particular requirements. İncele

- Evidence of term, residence and you can money

- Photocopy out-of a valid passport and charge

- Content of possessions allowance page/consumer arrangement otherwise arrangement to offer, when the house is already shortlisted

- Passport size photos of the many people

- Cheque with the running costs

- Fuel out of Attorneys if appropriate

Financial processes:

.png)

To apply for a mortgage, you will want to complete new duly occupied home loan application plus the requisite records with the bank often individually or because of a great POA proprietor.

Energy away from attorney:

Its preferred by hire all of your family relations once the Electricity out of Attorneys (POA) owner during the India. New POA owner is permitted operate on behalf of your as per the expert considering within the POA contract and you will your actual exposure need not be called for all the time getting processing/assisting your residence mortgage.

Maximum amount borrowed:

Generally speaking anywhere between 75% and you will 90% of the house prices is provided with because the that loan. İncele

You to definitely choice is to possess a major endeavor shareholder to add an excellent partial or complete ensure towards enterprise obligations. Particularly:

- During the 1997, an excellent concession on eastern part of metro Manila try issued into Manila H2o Organization, a beneficial consortium led by Ayala Firm of Philippines, that have passion of Joined Tools, Bechtel, while the Mitsubishi Corporation. Regarding wake of Western Economic crisis, the Manila Liquids Organization is actually not able Hawai. property installment loan law to increase debt to invest in opportunities into the a low-recourse endeavor financing-basis, so Ayala given a business ensure to back up the project providers.

- When you look at the 1992, an oil pipeline in the Colombia had been developed once the a shared-strategy between the federal oil organization and you can in the world oils companies which have the IFC as head financial. During the time, the new IFC is worried about you’ll be able to guerilla attacks and also the project stalled. İncele

The security getting a home loan is the assets itself. Guarantee denials may appear when property appraisals is less than questioned, otherwise when home inspections let you know high real items. According to the factors lenders report less than HMDA, White candidates become more probably than Western, Black, otherwise Latino individuals to get denied to possess causes related to guarantee. 4 Since revealed when you look at the Shape step 3, just after modifying on the app functions, one of refused applications, Latino people is 5.six per cent less likely to end up being refused to possess insufficient security, Black colored people 14.dos per cent less likely, and Far-eastern individuals twenty two.8 percent unlikely.

This type of results try not to oppose proof bias from inside the assessments otherwise appraisals-however, predicated on stated denial grounds, these biases are unlikely to-be an important drivers from old-fashioned mortgage approval disparities.

Once applicants have advice, lenders need to be sure it. This new Unverifiable advice denial reason ways the lending company are unable to show everything you to the a loan application. İncele

For VPN suggestions, take a glance at our guide to one of the best VPNs to better protect your kids’ web expertise. Parental management apps are a nice way to monitor and limit your child’s online activity. Apps like MMGuardian have tons of tools to help parents maintain their youngsters protected. This includes a subtle […]

De empezar, el craps sería mayoritareamente un esparcimiento sobre casino acerca de vivo. Si tenemos algo cual las jugadores online echan de menor para casinos físicos es nuestro excelente universo cual si no le importa hacerse amiga de la grasa respira en varones. İncele

“свободное Зеркало На следующий%2C Вход На официальному Сайт%2C Играть Онлайн В Автоматы в Деньги Или же Демо Версии Content Q%3A Как Я знаю Пройти Верификацию и Сайте Гама Казино Чтобы Играть в Реальные Деньги%3F Игры На Gama Casino 🎮 В Мобильной Версии напрашивается Выигрышей Из Онлайн Казино Как выбрал Слот Или Игровой Автомат Для Игры […]

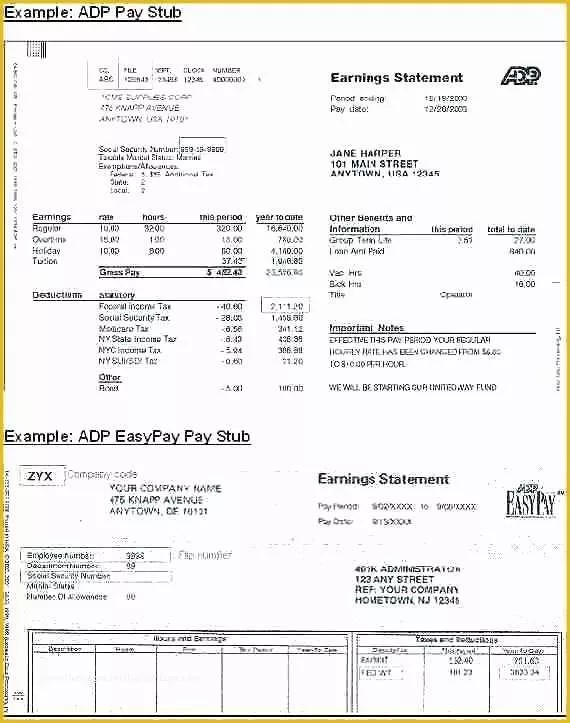

2. Gift money

Money given of a family member to the a down payment have to be skilled, as opposed to borrowed. Paperwork required with something special Page saying that cost is actually maybe not expected. Confirmation of transfer of money is even necessary.

step 3. Secured finance

Finance drawn facing a secured item (such a pension account , vehicle or other real estate house) wanted files and confirmation of your own deposit to your a drinking water membership.

cuatro. Liquidation off property

The fresh deals of financial support levels particularly stocks, securities and you may advancing years membership need records, just like the really does the latest selling from personal assets.

5. Seasoned dollars

Bucks is not an acceptable way to obtain loans to have a down-payment whilst can’t be recorded. For those who have cash on give, deposit the funds for the a liquids account (discover #1 over) and just have all important site of them experienced. İncele

To move of strictly monetary interests that Judge have discover so you’re able to justify disturbance that have deals, this situation determined that good state’s demand for the protection and you can wellbeing of their residents is a genuine justification for disturbance that have contractual personal debt.

This case challenged a good Pennsylvania rules one blocked exploration who does wreck present formations by removing helps regarding underneath. Multiple exploration enterprises confronted this rules, stating that they tampered towards the accountability risks on deals that body customers accepted as part of the bargain. The official argued so it got a desire for public shelter, homes preservation, or other justifications.

New Courtroom sided to your state, saying that whilst legislation did nullify the latest waivers out-of accountability that coal enterprises managed to obtain in the body citizens; not, the newest country’s demand for to prevent environment destroy and you may harm to people and their buildings outweighed this desire. This is exactly even more consistent with the societal indisputable fact that the newest excuse shall be having social benefit and you can shelter, and Legal recognized one to most other defenses validate such as for instance vastly important consequences towards the bargain liberties.

Sveen v. Melin, 584 U.S. ___ (2018)

Contained in this previous decision, this new Courtroom made clear not all of the regulations that perception pre-existing deals break the newest Deal Term. İncele

Letters October. 10: Doing your most useful; investing holds is a dangerous topic; no nuclear energy

With encouragement, can be done your best

Into the 2015 I took part in my personal basic structured run. My personal son are eagerly degree with the Royal Victoria 50 % of race and considered me personally you might come in the seven kilometre work at.

I became a typical and you may quick walker however, had no studies otherwise expertise in running. I did not very own right shoes but it seemed instance more pleasurable than simply standing on the fresh sideline holding their coat, and so i subscribed due to the fact an effective 72-year-old.

I did not understand what can be expected to the competition date however, We rapidly discovered that you become created in a speed category and you may move ranks during the group.

I realized I happened to be going out of commander so you can lover having one lady particularly. From the halfway due to I said to their own we would like to cross this new finish line together.

She don’t disagree so we continued exchanging ranking. Towards result in vision she told you she would run the rest of the method.

I tried to keep however when she spotted myself failing she got my wrist and you can produced me personally over the finishing line with her. I became so pleased!

It’s a sensational memory and it started me personally toward an enjoyable duration off preparing for five-, eight- and 10-kilometre incidents for the adopting the years.

I send my personal good luck to any or all earliest-date runners, particularly the elderly, contained in this year’s enjoy. I’m hoping the thing is that the fresh support you should do your most useful.

Spending are a risky business

Therefore i would ike to get this straight. A beneficial Sooke carpenter in his 30s who was simply nonetheless renting an flat and you will investing Tesla inventory just like the their early twenties, was able to started to a stock worth of almost $50 mil. İncele

- LIC Mortgage Eligibility Calculator

- LIC Financial EMI calculator

- LIC Mortgage Rate of interest

- Pertain Today

LIC Mortgage Qualifications Calculator and you can Conditions

60 years/Retirement age, any been before. Age of the fresh new applicant cannot go beyond 58 age or the retirement age in advance of maturity of construction financing.

Minimal websites monthly income you’ll need for a good salaried individual to help you submit an application for an effective LIC Financial is Rs. 15, 000/-

The minimum online month-to-month income needed for a personal-operating business owner to apply for a housing mortgage was Rs. fifteen, 000/-

According to money qualifications and cost of the home LIC domestic fund can move up to Rs. Cr or higher

LIC Mortgage Eligibility Factors

LIC Property Funds Minimal also provides home loan away from only Rs. step one.00 Lacs so you’re able to Rs. Cr or even more at the mercy of the mortgage candidates fulfilling very first eligibility standards out-of LIC HFL. Home loan eligibility from a debtor in LIC HFL utilizes after the affairs:

- A job Sounding loan candidate

- Age mortgage applicants

- Net gain domestic earnings regarding financing candidates

- Borrowing bureau score (CIBIL Rating) from applicants

- Worth of

LIC Financial Eligibility Predicated on A position Types of

LIC Construction Financing providesHome loans to Indian People dealing with various MNCs working from inside the India, Indian Private market businesses otherwise Societal sector organizations, Defence Qualities etcetera. İncele