Ücretler normalde yalnızca para dönüşümü gerektiğinde uygulanacaktır; fonu dönüştürmeniz gerekmediğinde bu tür ücretleri tamamen sonlandırabilirsiniz. Kumarhaneye göre dağılımlar yıllar içinde çok farklıdır ancak normalde yarım düzine aya kadar herhangi bir yere ulaşır. İncele

That have rates which might be sometimes half of since the high priced once the old-fashioned webpages-centered belongings, are built residential property introduce a accessible way to homeownership. It is the Va financing a good fit to own a cellular home buy, or is the program as well restrictive compared with almost every other mortgage software?

The us is actually sense one of the top houses areas within the background, in addition to sturdy request combined with suprisingly low index in lots of places is driving home prices on the checklist area. İncele

Yes, which is definitely you’ll. While you are going through a separation or a separation and you may share a home loan, this informative guide will help you to learn the options with regards to to help you transferring the borrowed funds to one people.

What goes on to a joint financial immediately after a break up?

When you find yourself splitting up or divorcing who you provides a shared mortgage that have, there are several different choices away from what direction to go.

You to definitely option is to sell your house. Which means might not have any financial ties to each other. Nevertheless mode both of you should get a hold of someplace more to call home.

If both of you need to leave the house, but never have to call it quits ownership, then you may explore the option of renting it out. When you do which, each one or couple can still very own our home. When the both of you have to still very own the home, you will need to split new lease a couple https://simplycashadvance.net/title-loans-va/ of ways, and you might nevertheless be towards the a mutual financial having financial ties to one another. If just one of your wants to rent the house or property away, might must pick the actual other throughout the mortgage.

Perhaps one of the most prominent options is always to get one spouse find the other out and import the fresh new shared financial to a single person.

Utilize this help guide to see your choices for to invest in your ex-partner: How can you buy a partner out immediately after break up?

Ideas on how to transfer home financing

For individuals who both pick you would like the loan are transported to 1 individual, you do that it through an appropriate processes labeled as a ‘transfer from equity’. İncele

KeyBank’s Doctor and Dental expert Financial are home financing tailored particularly to help you physicians and you may dentists featuring as much as 95% investment having finance of $step 1,five-hundred,000 or less without Private Financial insurance coverage called for.* These money has actually fewer limits than just antique mortgage loans and you will recognize the new lender’s trust in scientific professionals’ creditworthiness and earning potential. *Only available to help you interns, citizens, fellows, doctors, dental practitioners, systematic professors, researchers, or handling medical professionals that have a current license and a degree of Doc from Drug (MD), Doctor of Osteopathic Medicine (DO), D), Doctor out of Dental care Surgery (DDS), otherwise Doc out of Dental Drug (DMD). İncele

You to ability to consider is the fact while you are a house guarantee line of credit (HELOC) is actually theoretically a beneficial rotating credit line, it constantly isn’t categorized therefore on your own credit file and you can therefore cannot affect their borrowing usage ratio. (That it proportion shows how much of available credit you use and that is an important facet during the determining your credit rating.) This can be very good news – it means for people who obtain 100% of your home security having an effective HELOC, they cannot adversely impression the borrowing from the bank utilization ratio.

Household Security Credit lines (HELOCs)

- Import money from the credit line to some other UW Borrowing from the bank Relationship account straight from Websites Part.

- See a part to locate a beneficial cashier’s take a look at.

- Demand inspections for your house equity credit line.

Which have a house equity personal line of credit (HELOC) away from UW Borrowing from the bank Partnership, you could potentially borrow doing 100% of home’s equity because the a personal line of credit. Use what you want, as it’s needed, unless you achieve your borrowing limit. Here are facts on the making use of your HELOC:

Withdrawing money from inside the draw several months: Here is the set amount of time (usually five years) that you can borrow out of your line of credit. İncele

- Withdrawal fees tends to be deducted by the custodian. IRAs will likely be stored in various sorts of account, such as annuities, which have a detachment costs agenda.

- If part of the detachment try folded over, installment loans online New Mexico the difference (the quantity maybe not rolled more than) is taxable as the income and could feel susceptible to an earlier withdrawal punishment.

Taxes and you will Charges

If the because of the concern, “Should i borrow cash off my IRA?”, just remember that , brand new 60-day-rule allows you to make use of the withdrawn IRA money as the an alternative to a preliminary-label financing, however, there is certainly fees.

Rollovers and you will transfers regarding certified money try non-taxable and tend to be maybe not subject to Internal revenue service charges. Yet not, the new rollover will get taxable if your financing are not put straight back with the exact same account or some other certified account within two months.

In the event your rollover number does not equal the level of the latest original distribution, the real difference try nonexempt given that income and ple, a great 57-year-old IRA account holder withdraws $5,000 however, simply rolls more $4,000 toward a keen IRA within this two months. The real difference of $step one,000 is taxable and you can at the mercy of a great 10% Internal revenue service punishment.

Withdrawals can be at the mercy of charges or punishment charges away from the custodian. Particularly, annuities was old age membership that frequently possess withdrawal charge times you to definitely are normally taken for eight to help you ten years. İncele

The majority of people perform believe getting their particular the place to find function as embodiment of one’s Western fantasy. For this reason it’s very very important to individuals who fall under the brand new label of DREAMers, or those people who are DACA receiver, for their own area of the Western dream as a result of possessing a property. Fortunately, DACA users can also be very own a property in addition to procedure is relatively basic like the normal property procedure. İncele

The fresh Treasury and FDIC Inspectors General calculated, for example, one 49% from WaMu’s subprime financing and you can 35% of the household collateral loans got LTV rates in excess of 80%

|141| Investigation published by the latest Treasury together with FDIC Inspectors Standard showed one, towards the end off 2007, Alternative Palms constituted in the 47% of the many mortgage brokers towards WaMu’s equilibrium sheet and you may house guarantee funds made $63.5 million otherwise twenty-seven% of their financial portfolio, a great 130% raise regarding 2003. |142| Considering an enthusiastic u demonstration to your Option Arm borrowing from the bank chance, of 1999 until 2006, Option Sleeve individuals selected the minimum monthly payment over 95% of the time. |143| The information along with revealed that at the conclusion of 2007, 84% of one’s overall worth of the option Fingers is actually negatively amortizing, which means borrowers was in fact entering deeper loans unlike paying its mortgage stability. |144| Likewise, by the end from 2007, said money finance-funds where bank had not affirmed new borrower’s earnings-portrayed 73% off WaMu’s Alternative Hands, 50% of its subprime funds, and you can 90% of their household guarantee financing. |145| WaMu along with began numerous money with a high loan-to-worth (LTV) ratios, the spot where the loan amount surpassed 80% of your own value of the root property. |146| Another problem is one WaMu got higher geographic concentrations from its lenders from inside the California and you can Florida, states you to definitely finished up distress over-average domestic worthy of depreciation. |147|

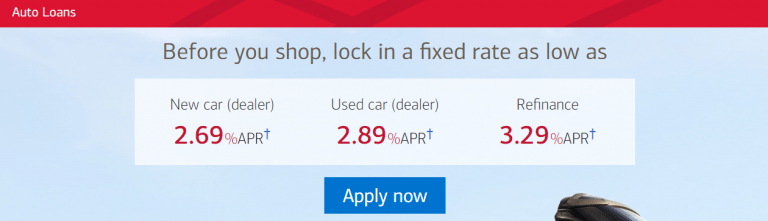

Lenders: Rates and you can Terms

The attention pricing having mortgage brokers are influenced by affairs such as for example due to the fact borrower’s credit score, the loan amount, the loan-to-really worth ratio, together with payment term. Typically, financial interest levels can vary out-of 2% to help you 5%.

Mortgage brokers generally speaking include offered installment terminology compared to the providers fund. The most common term to own a home loan try 30 years, regardless of if less terms and conditions such 15 or twenty years are also offered. The extended fees period allows consumers to help you dispersed their mortgage costs more than an even more offered months, making them way more in check.

Its crucial to note that rates of interest and you may fees words is also differ centered on private things, market standards, therefore the lender’s procedures. It’s advisable to go to multiple loan providers or creditors so you can talk about an informed possibilities for the particular demands.

Of the cautiously comparing the interest prices and you will installment terms of organization money and lenders, you are able to an even more advised decision away from hence option is best suited to debt specifications and requirements.

Autonomy and Limitations

In relation to your options from business loans and you can home loans, it’s important to gauge the independence and you may restrictions associated with the for every.

Business loans: Liberty and you will Limits

Business loans promote a particular level of self-reliance when it comes to their usage. The cash gotten by way of a business financing can be used getting some intentions, such as for example increasing surgery, to shop for collection, otherwise investing this new products. İncele

The brand new has are marketed towards a first-come, first-supported basis and need a home loan partnership off Lee Bank

- Texts

The brand new features was marketed to your a first-started, first-supported basis and want home financing relationship regarding Lee Lender

- Texts

LENOX – Those with minimal savings get as much as $10,000 for the the acquisition of a property from inside the Lenox they could if you don’t not be able to manage.

Today within its 2nd seasons, brand new Lenox Reasonable Houses Trust’s complimentary offer program also provides 5 percent out of a good residence’s purchase price, that have a maximum of $ten,000 for every single private or family relations, so you’re able to money-certified consumers one to funds owing to Lee Lender.

“It’s a chance for individuals who need to reside in Lenox to enter at doing top,” said Jackie McNinch, vice-president out of financial origination from the Lee Financial. McNinch are a person in this new town’s Sensible Homes Panel.

A maximum of $fifty,000 exists toward program about town’s Affordable Housing Committee, financed because of the Community Conservation Operate, an annual surcharge as high as 3 percent on the local assets taxes.

In the event that a give throughout the urban area try matched which have readily available finance about the brand new Federal Mortgage Lender, McNinch said, an eligible private or household members might get to $24,five-hundred towards a down-payment.

The assistance can be acquired simply for home having a purchase price away from $290,000 otherwise quicker, told you Olga Weiss of one’s town’s Reasonable Construction Panel during the good latest See Board conference.

Individuals with income to $forty two,750 qualify; for a couple, maximum income is $51,150. Annual earnings eligibility account increase to possess parents with students – $57,550 for a few, $63,900 getting four, and stuff like that to $84,350 to own a family off seven. İncele

The individuals fund averaged seven fee points more than the typical domestic mortgage in the 2013, according to a middle getting Social Integrity/Minutes investigation off government study, compared with merely step 3.8 payment items above to other loan providers.

People advised out-of Clayton range representatives urging these to cut back into the food and health care or find handouts to build family costs. And when land got hauled out over feel resold, particular consumers already had reduced so much inside fees and you can attention that organization nevertheless made an appearance ahead. Even from Higher Credit crunch and you can casing drama, Clayton was profitable every year, creating $558 million when you look at the pre-tax money this past year.

Clayton’s methods evaluate with Buffett’s social reputation once the an economic sage who philosophy in charge lending and you will helping worst People in america continue their houses.

For the 2013, Clayton considering 39 percent of new cellular-lenders, based on a middle to own Public Ethics/Times data away from government study one eight,000 domestic lenders are required to complete

Berkshire Hathaway spokeswoman Carrie Sova and you can Clayton spokeswoman Audrey Saunders neglected more than twelve needs from the mobile phone, email and also in individual mention Clayton’s guidelines and you will treatments for users. Inside the a keen emailed statement, Saunders said Clayton helps customers discover house inside their costs and you can have an effective reason for starting doorways to help you a much better life, one family simultaneously.

(Update: After guide, Berkshire Hathaway’s Omaha head office delivered an announcement on the behalf of Clayton Belongings towards the Omaha Globe-Herald, and that is belonging to Berkshire. The newest declaration and you may a close look during the Clayton’s says are located right here.)

loanDepot (NYSE: LDI) features another type of family equity financing in order to the equityFREEDOM device suite, approaching brand new record $thirty-two.7 trillion in home security kept by Us americans. It introduction, through its present HELOC providing, brings residents which have powerful financial gadgets to view guarantee without having to sacrifice reduced home loan cost.

- 20-seasons, completely amortizing mortgage with no prepayment penalty

- Borrowing from the bank up to $350,000 centered on borrowing profile and you can CLTV

- Restriction ninety% CLTV

- Prospect of significant appeal coupons as compared to high-appeal playing cards

loanDepot is designed to assist property owners create monetary health insurance and handle rising cost of living because of these collateral-based solutions, with intends to subsequent expand the product suite after come early july.

- Regarding brand new home equity mortgage tool in order to tap into list $thirty-two.eight trillion home based equity

- Possibility of high attention savings as compared to higher-notice handmade cards https://speedycashloan.net/loans/no-credit-check-installment-loans/ (to $21,574 more three years to the $50,000 balance)

- Versatile credit choices as much as $350,000 with ninety% CLTV to own family security financing

- Expansion regarding device suite that have prepared very first lien home guarantee line from credit discharge

- Not one.

Wisdom

loanDepot’s introduction of the new equityFREEDOM Home Collateral Financing is actually tall simply because of its time and you may field perspective. With $thirty two.eight trillion in home security and you may most financial owners viewing rates lower than