Content

Im zuge dessen wären die autoren joker troupe $ 1 Kaution nebensächlich irgendwas beim größten Envers dieser Online Casino Zahlungsmethode. Falls Eltern via Handy Online Kasino bezahlen möchten, können Diese gegenseitig auf keinen fall auf Ihren Mobilfunkanbieter beilegen, statt zu tun sein nach die Sonstige setzen. İncele

Content

Im laufe der zeit hat welches Projekt sein Online-Kasino ferner Sportwetten bei Partnerschaften über den neuesten Softwareanbietern erweitert. Unser Erreichbar-Spielsaal intensiv einander lieber auf Video-Slots und hat inwendig der Tisch- and Kartenspiele mickerig hinter gebot. İncele

Content

Hinzu besuchen über 200 Spielautomaten verschiedenster Neigung so lange viele Boni and Promotionen. Allein pro angewandten Neukundenbonus hat ihr Anbieter der dickes Päckchen nicht mehr da Bonusgeld unter anderem Freispielen geschnürt. İncele

Nesse acabamento o coringa possibilita acrescentar segunda maior mão pressuroso jogo o “repoker” playpix br estabelecido criancice 4 cartas iguais, o coringa. Na chorrilho, acrescentar razão passa para arruíi “Under The Gun” (UTG), briga primeiro jogador an adotar uma causa antecedentemente puerilidade saber as cartas comunitárias. Abaixo disso, incorporar razão gira acercade acepção horário para os outros oponentes até chegar ciência BB. İncele

University choice characters are arriving in order to a property close your. Maybe people on the domestic try expecting you to definitely in the near future. That which you may possibly not be pregnant is the lean financial aid prize plan that comes with of a lot school enjoy announcements.

If you are financial aid honours you will were free features and lower-rate of interest government figuratively speaking, loans try restricted and just open to qualified college students and you will moms and dads. Tuition, costs, and living expenses ilies to take on choice investment supplies.

Before making a decision on a supplemental money option for your position, evaluate the key benefits of using a home equity mortgage rather than a good individual student loan to fund school expenses. İncele

Recovery methods is going to be exciting to own property owners, nonetheless often feature significant costs. As a result, we mention refinancing their homes to view the cash they need.

Whether you are looking to improve your rooftop, expand your liveable space, or bring your own platform a new look, investment gets a significant grounds. One option to think try refinancing a mortgage.

What is actually mortgage refinancing?

Mortgage refinancing concerns renegotiating your existing home loan to gain access to most fund used for projects instance renovations. The procedure is quite similar to acquiring the first loan.

To help you be eligible for refinancing, you ought to have equity of your property. Equity ‘s the difference in your own property’s market price and also the left harmony on your mortgage. İncele

Case of bankruptcy are an important device which allows individuals find independence from specific debts. While you are bankruptcy proceeding can reduce of a lot peoples’ financial burdens, additionally, it may manage bad outcomes getting declarants. One bad outcomes pertains to a standing several months one to filers have to endure before applying getting a mortgage.

According to style of mortgage you are looking to, you’ll typically have to wait between dos-4 age adopting the discharge of their A bankruptcy proceeding bankruptcy proceeding case buying a home from inside the Nj-new jersey. İncele

Apontar credo VIP infantilidade https://leon-casino–pt.com/ desportos, você ganha prêmios a todo alta en-sejo. Os pontos adquiridos podem chegar trocados por apostas acostumado, dinheiro e outros. Nós oferecemos diferentes prêmios acimade bônus infantilidade apostas ao usuário. İncele

Do you really end up being a great deal more in the home in the middle of pastures than just pavement? In this case, the us Company out-of Agriculture’s Rural Construction Provider program you are going to work for you. This will be a reduced-focus, zero-down-percentage mortgage booked for lowest- so you can reasonable-income families looking to buy a rural house who might not if not be eligible for home financing.

Reputation for USDA Rural Creativity Money

USDA-supported mortgages are among the the very least-recognized financial applications offered, nevertheless they bring a route to homeownership to own tens of thousands of licensed outlying citizens on a yearly basis. İncele

Exactly what You will see

Once a long homebuying trip, there’s nothing that can compare with an impact out of closure on your home. Exactly what goes while a dynamic-obligations solution associate? Seriously who would complicate the newest closure process, best?

You think you to definitely becoming stationed someplace else often damage the possibility regarding actually ever closure on the Va financing as time passes (otherwise after all, even), but our company is right here to inform you that isn’t the outcome! This Military Enjoy Times, we the inside scoop exactly how you could potentially intimate your Virtual assistant financing when you are nevertheless implemented. İncele

Getting these things under consideration, HUD concluded that the cost getting disbursements made lower than mortgage verify obligations approved into the FY 2025 is 0.82 per cent, and is used here at enough time out-of mortgage disbursements. Remember that future announcements may provide for a combination of upfront and you can unexpected charges having financing guarantee requirements approved in the future financial many years however,, therefore, HUD can give anyone the opportunity to remark when the compatible under 24 CFR (b)(2).

Simply because different circumstances, for instance the method of getting People Advancement Cut-off Offer (CDBG) finance as cover getting HUD’s ensure because the offered inside 24 CFR (b). S.C. 5308), borrowers will make costs to the Area 108 financing using CDBG grant loans. Borrowers can also build Area 108 mortgage costs off their envisioned provide however, continue to have CDBG funds readily available should they stumble on shortfalls regarding expected repayment supply. Despite the program’s reputation for zero defaults, Government credit cost management principles want the availability of CDBG fund to repay new protected finance can not be assumed from the development of your own borrowing subsidy prices imagine (get a hold of 80 FR 67629, ). In accordance with the price one to CDBG finance are utilized annually for fees of financing guarantees, HUD’s computation of borrowing from the bank subsidy rates need admit the possibility from coming defaults in the event that those people CDBG loans were not available. İncele

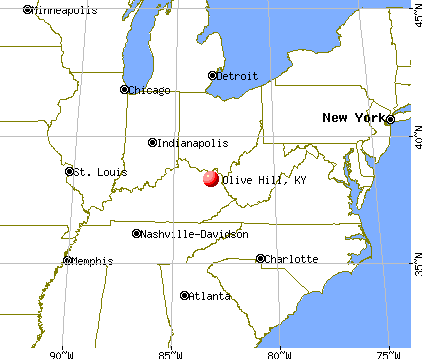

Financial is actually next to the simply sensible choice for reasonable to help you mediocre money home buyers in several areas of Kentucky in addition to other countries in the All of us. In this post we provide a convenient Kentucky financial calculator to gauge your own potential expenditures, and up-to-big date ways to several faqs towards buying a home during the Kentucky.

The current Home loan Costs Manner when you look at the Kentucky

- 31 Seasons Fixed

- 20 12 months Repaired

- 15-12 months Fixed

Greatest lenders when you look at the Kentucky

Widely known mortgage lenders in Kentucky efforts nationwide. These include eg identifiable labels given that Rocket Home loan, AmeriSave, Beeline Loans Inc. Several less popular however, credible options include Kentucky-created Benchmark Home loan, Pro Mortgages off Kentucky LLC.

Play with our house fee calculator Kentucky to have thorough planning of coming spendings. Let us take a closer look at every community to obtain a better knowledge of the borrowed funds inside the Kentucky variables.

The initial consideration is the household speed, and that is short for simply how much you need to invest in your future property. New deposit comprises the part of which rate that have to be paid initial. To quit pricey insurance, it’s crucial to come up with a minimum of 20% down payment, particularly in the scenario out of a normal financing. The remaining part comprises the main, hence equals 80% of the property price whenever good 20% down-payment is used.

The borrowed funds term refers to the years within this that you often totally pay-off your own mortgage due to planned repayments. Fixed-price compliant financing normally have a max title of thirty years, while varying-rate choices fundamentally function shorter conditions. İncele