Blogs

Added bonus depreciation is not capped in relation to bucks; a whole multiple-million deduction for the whole price of one is generally accepted in one year. Simultaneously, Point 179 deductions were restricted to 1,080,100 to own 2022 (according to dos,700,100 financing devices purchase). The brand new added bonus depreciation laws apply at possessions received and you can put operating once Sept. 27, 2017 and you will prior to Jan. step one, 2023. Yet not, the present day extra decline phase away schedule gets to 2026.

- Taxpayers can always choose never to claim incentive decline for the group of property placed in provider while in the people taxation seasons.

- Taxpayers usually and get depreciable property such as machines and you may gizmos before they begin the meant money-producing activity.

- Decline will get tricky, so you should along with keep in touch with a taxation elite before filing.

- Taxpayers have to include back 80percent of your government depreciation incentive to the Minnesota return in the first seasons and then 20percent from the brand new create-straight back matter might be subtracted inside the each of the next four years.MOYes.

Entrepreneurs just who individual numerous citation-thanks to businesses, and S organizations, limited obligations enterprises , and you will partnerships, have to bundle Area 179 write-offs very carefully. Qualified upgrade possessions boasts any improve to the interior percentage of nonresidential atlantis queen $1 deposit structures if improvement is put in-service pursuing the time the structure try placed in services. Which slow phase-out from the bonus depreciation percentage gift ideas an alternative believed chance for enterprises. But not, Part 179 and bonus decline are only available for team property you placed in provider inside the tax year. Property is “listed in solution” if it is in a position and you will available for their assigned function in your company.

Mi No deposit Gambling enterprises | atlantis queen $1 deposit

Income tax deductionA taxation deduction is a provision you to definitely minimizes taxable income. Itemized write-offs is actually well-known among large-earnings taxpayers which will often have high deductible expenses, such county and you will local fees paid back, home loan focus, and you can charitable benefits. Try an income tax to your income away from a business; securely outlined, income is equal to revenue quicker the expense of generating the brand new revenue. Beneath the current taxation password, businesses are generally permitted to deduct the expenses in they occur whenever calculating the income to have income tax motives. However, particular prices are delicate, otherwise disallowed, and that incorrectly describes, overstates, and you will overtaxes profit. So it report talks about issue of how the costs of financing possessions will be retrieved, just how structures are treated under the most recent taxation password, plus the monetary and you will financial impression from extending full expensing so you can the brand new nonresidential structures.

Resources of U S Tax Revenue Because of the Taxation Kind of, 2024 Upgrade

The newest tax password try heavily biased facing money in the structures and you will, everything else equivalent, stretching full expensing to those money possessions do increase investment and you may the brand new enough time-work with size of the new economy. As well as the day value of currency, a buck later on may be worth lower than a buck today. Hence, delaying deductions for the cost of team investment ensures that the brand new actual worth of the new deductions is lower than the original cost.

Increasing Bonus Decline Which have A cost Segregation Research

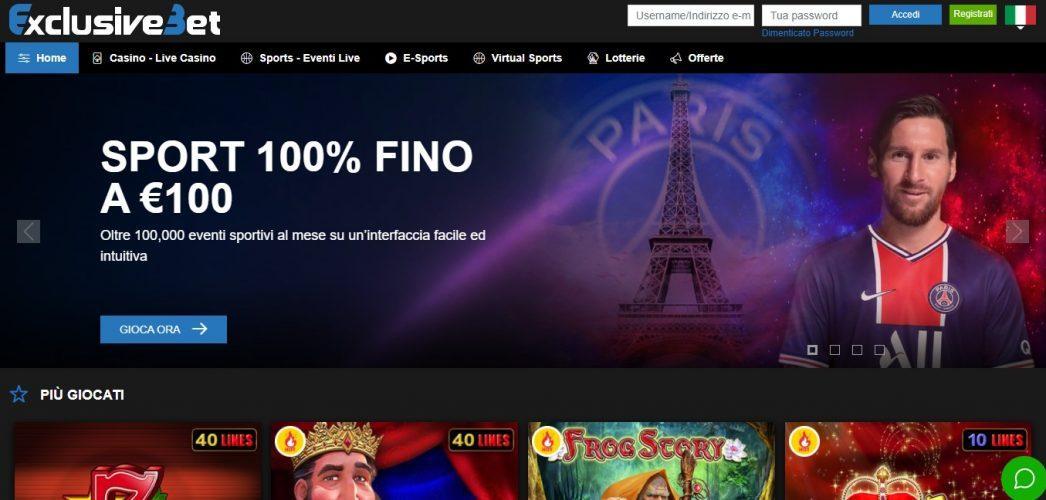

The bill includes100percent bonus decline, allows for quick search and development expensing and you will increases the child Income tax Borrowing from the bank. With no deposit bonuses, the brand new gambling enterprise provides you with a small amount of totally free loans to have fun with. Possibly the most important topic is to look at the terminology and requirements of your own no-deposit added bonus, such as go out restrictions and wagering standards. A good looking bonus could possibly get include small print, which will indeed allow it to be even worse than a smaller extra with more advantageous conditions and terms. There are currently four All of us says offering real cash zero put gambling enterprises. Such claims are Nj-new jersey, Pennsylvania, Michigan, and you will Western Virginia.

Relevant Recovery Symptoms The real deal Possessions

Currently simply a number of gambling enterprises on the Keystone State give no-deposit incentives. A no deposit incentive is a type of gambling establishment invited bonus provided by web based casinos to get new customers or even to maintain existing people. The way in which which incentive type of work is that you rating an enthusiastic extra without having to exposure many very own money. This type of incentive incentives may take the type of more money, totally free revolves, totally free chips, or any other type of subservient extra.

Betmgm Gambling enterprise Customer care

The new Income tax Basis General Equilibrium Design rates one to on the an energetic foundation, enacting complete expensing for new nonresidential formations create help the a lot of time-work on sized the new economy because of the 1.cuatro %. Complete expensing for formations manage result in an excellent dos.six % huge money stock, a 1.dos % boost in earnings, and you may a supplementary 224,100000 complete-date comparable efforts. It doesn’t mean you to definitely zero investment inside the formations happen less than the present day system out of depreciation, but one beneath the large limited effective tax speed because of deprecation, smaller effective ideas may not be experienced sensible to take care of. Lowering the marginal energetic taxation rate by the progressing in order to complete expensing to own formations do help the quantity of it is possible to plans who does getting successful after tax, and you can most likely result in an expansion in the funding stock.